The fintech industry is evolving rapidly in 2024, shaped by technological advancements, regulatory changes, and shifting consumer expectations.

From record-breaking investments to shifts in market dynamics, this report examines the key trends, players, and categories defining the future of financial technology.

1. Biggest Media News in the Fintech Industry in 2024

In 2024, the fintech industry is experiencing significant transformations driven by technological advancements, regulatory changes, and evolving consumer preferences.

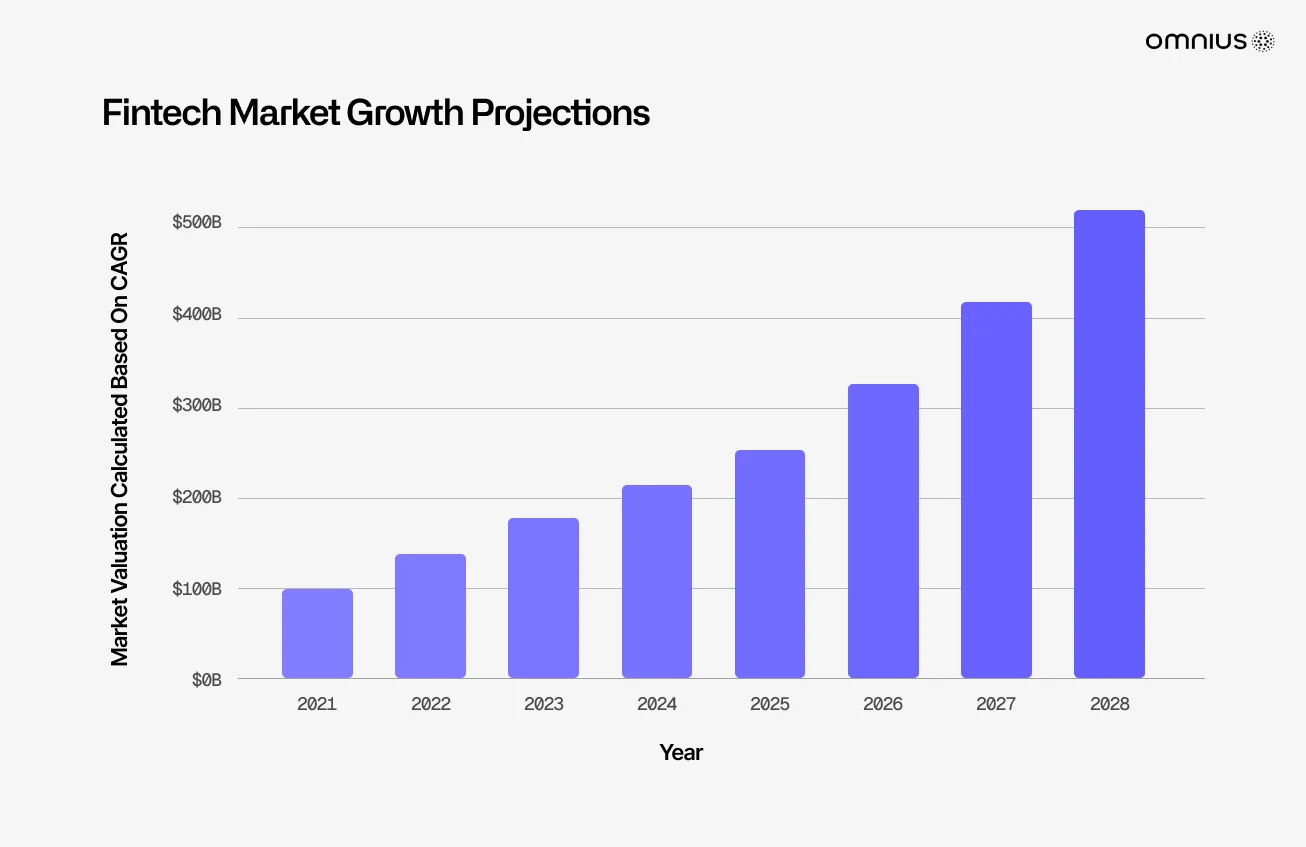

With all these transformations and improvements it’s not odd to hear that the Fintech industry is expected to grow at a CAGR of 16.5% from 2024 to 2032.

Here are some of the biggest media news highlights focused on specific companies and trends within the fintech sector:

- Block’s (formerly Square) Cryptocurrency Expansion: Block continued to invest heavily in Bitcoin and blockchain technology, expanding its crypto offerings through the Cash App.

- Stripe’s Expansion into Embedded Finance: Stripe has made headlines with its strategic move into embedded finance, allowing businesses to integrate payment processing directly into their platforms. This initiative is expected to enhance user experience and streamline transactions, positioning Stripe as a leader in the embedded finance space. Besides that, Stripe also acquired Lemon Squezzy and Bridge to make selling digital products easy.

- PayPal’s Entry into Crypto: PayPal has expanded its cryptocurrency offerings, enabling users to buy, sell, and hold various cryptocurrencies directly within their accounts. This move aims to capitalize on the growing interest in digital currencies and is part of PayPal’s broader strategy to become a comprehensive financial services provider.

- Revolut’s US Banking License: Revolut obtained a full banking license in the US, allowing it to offer a wider range of financial services to American customers. Revolut announced plans to expand its services into new international markets, including Asia and Latin America. This expansion is part of its strategy to increase its user base and diversify its offerings beyond traditional banking services.

- Visa’s Blockchain Initiatives: Visa deepened its involvement in blockchain technology, particularly focusing on stablecoin and central bank digital currency (CBDC) solutions.

- Plaid’s Open Finance Push: Plaid continued to advocate for open banking standards, launching new APIs to facilitate data sharing between financial institutions.

- Chime’s Mobile Banking Growth: Chime reported significant user growth, solidifying its position as a leading mobile-first banking platform.

- Nubank’s Expansion in Latin America: Brazilian neobank Nubank continued its expansion across Latin America, tapping into underserved markets.

- Klarna has become a top fintech founder factory, producing 62 second generation startups out of its alumni during this year, and has surpassed Revolut, which is now on second place with 49 startups founded by its ex-employees.

2. General Trends of the Fintech Industry 2024

2024 has been a year of consolidation and innovation in fintech.

The global fintech market is expected to grow to approximately $514.9 billion by 2028, reflecting a compound annual growth rate (CAGR) of 25.18%.

With billions of unbanked and underbanked people worldwide and GenAI’s boost to productivity, the potential for fintech remains vast.

However, several major trends are shaping the industry at the moment.

1. Rise of Central Bank Digital Currencies (CBDCs)

The development of CBDCs is reshaping the fintech industry.

Countries like China and the European Union are advancing their digital currency initiatives, prompting fintech companies to adapt their services accordingly.

The potential for CBDCs to streamline payments and reduce transaction costs is driving significant interest in this area.

Companies like Chime and Revolut are capturing significant market share by offering user-friendly interfaces and lower fees.

For instance, Chime reported over 22.3 million users, reflecting a 53% increase from the previous year.

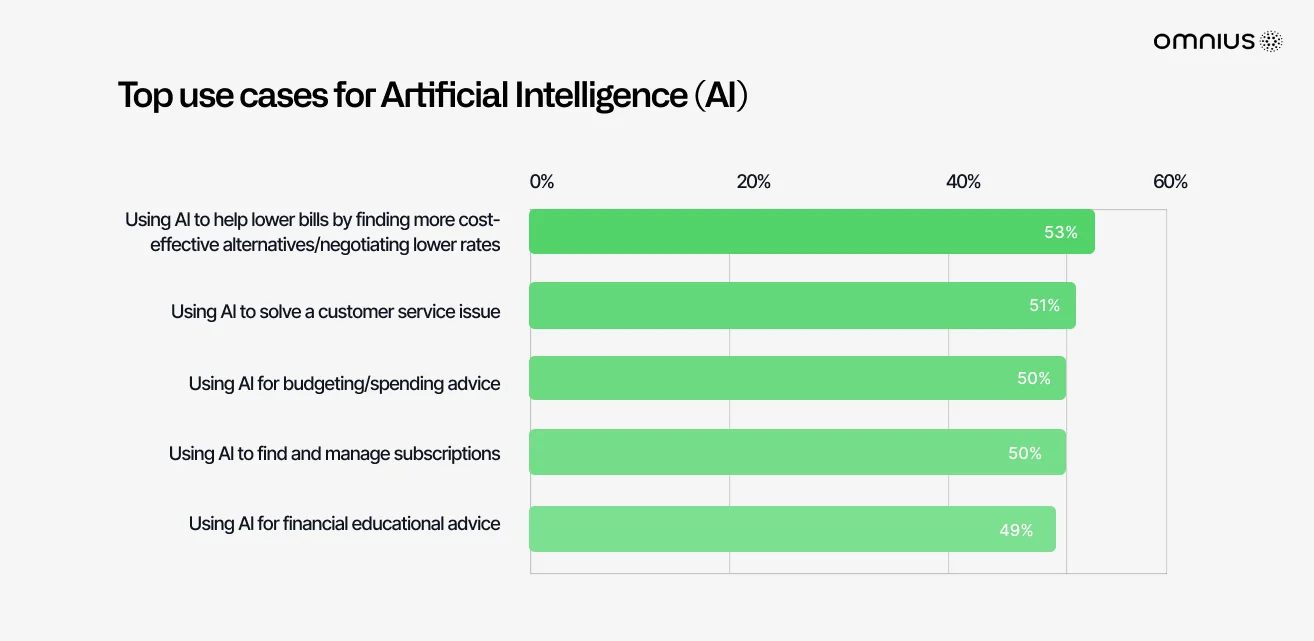

2. AI Integration

Fintechs increasingly utilize AI for risk management and personalized service.

Artificial Intelligence in fintech is valued at approximately $17 billion in 2024 and is expected to grow to 70.1 billion by 2033.

Companies like JPMorgan Chase, Goldman Sachs, and Nubank are at the forefront of this transformation.

Zest AI reported that its analytics platform has cut down loan processing times by 70%, enhancing the overall customer experience.

3. Sustainability Focus

Consumers are increasingly favoring firms with green initiatives.

Aspiration, for instance, gained over 1 million customers by tailoring products that encourage sustainable spending and investing.

4. Regulatory Adaptations

With stricter regulations coming into play in Europe and North America, companies are actively adjusting their operations to remain compliant.

Reports indicate that 80% of fintech firms are increasing their compliance budgets in 2024.

This new regulation mandates stricter compliance requirements, ensuring fintech companies can withstand and recover from disruptions.

Revolut and N26 are examples of companies adapting to these changes.

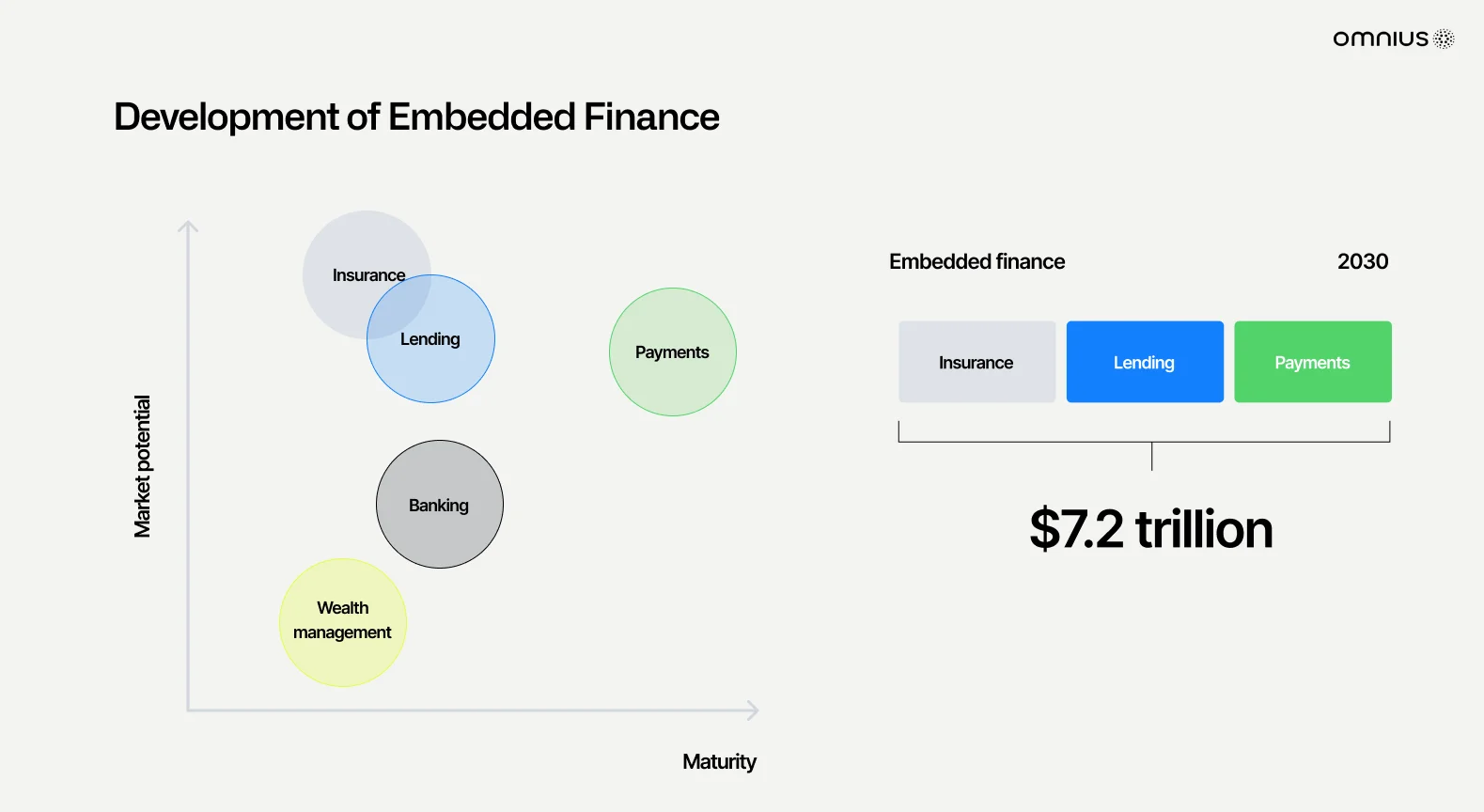

5. Embedded Finance

Non-financial companies are embedding financial services directly into their platforms, and this specific market size is expected to reach $7.2 billion in revenue by 2030, according to DashDevs.

With connected commerce, major banks finally have an opportunity to leverage their vast data on customer needs and behaviors.

GenAI is delivering huge productivity gains in precisely the areas where fintech costs are centered: coding, customer support, and digital marketing.

Fintechs, relative to other financial services players, will reap the biggest productivity rewards in the near term.

3. Biggest Players and Fintech Market Division in 2024

According to Reports and Data, market analysts predict the digital payments sector alone could reach $10.07 trillion by 2026.

Just in 2024, the fintech market is dominated by a mix of established players and innovative startups, such as:

- Traditional Banks:some text

- Transitioning to digital offerings—for example, JPMorgan Chase reported that digital transactions made up about 60% of its total transactions in 2024.

- Goldman Sachs collaborated with Stripe to enhance their payment processing capabilities.

- Challenger Banks:some text

- Payment Processors:some text

- PayPal reported $7.89 billion in revenue in Q2, showcasing an 8% increase compared to the same quarter in the previous year.

- Block(ex. Square) continues to grow, with a significant gross profit increase, growing by 20% to $2.23 billion.

The market is segmented into various categories, including payments, lending, personal finance, and investment management, with each category experiencing unique growth dynamics.

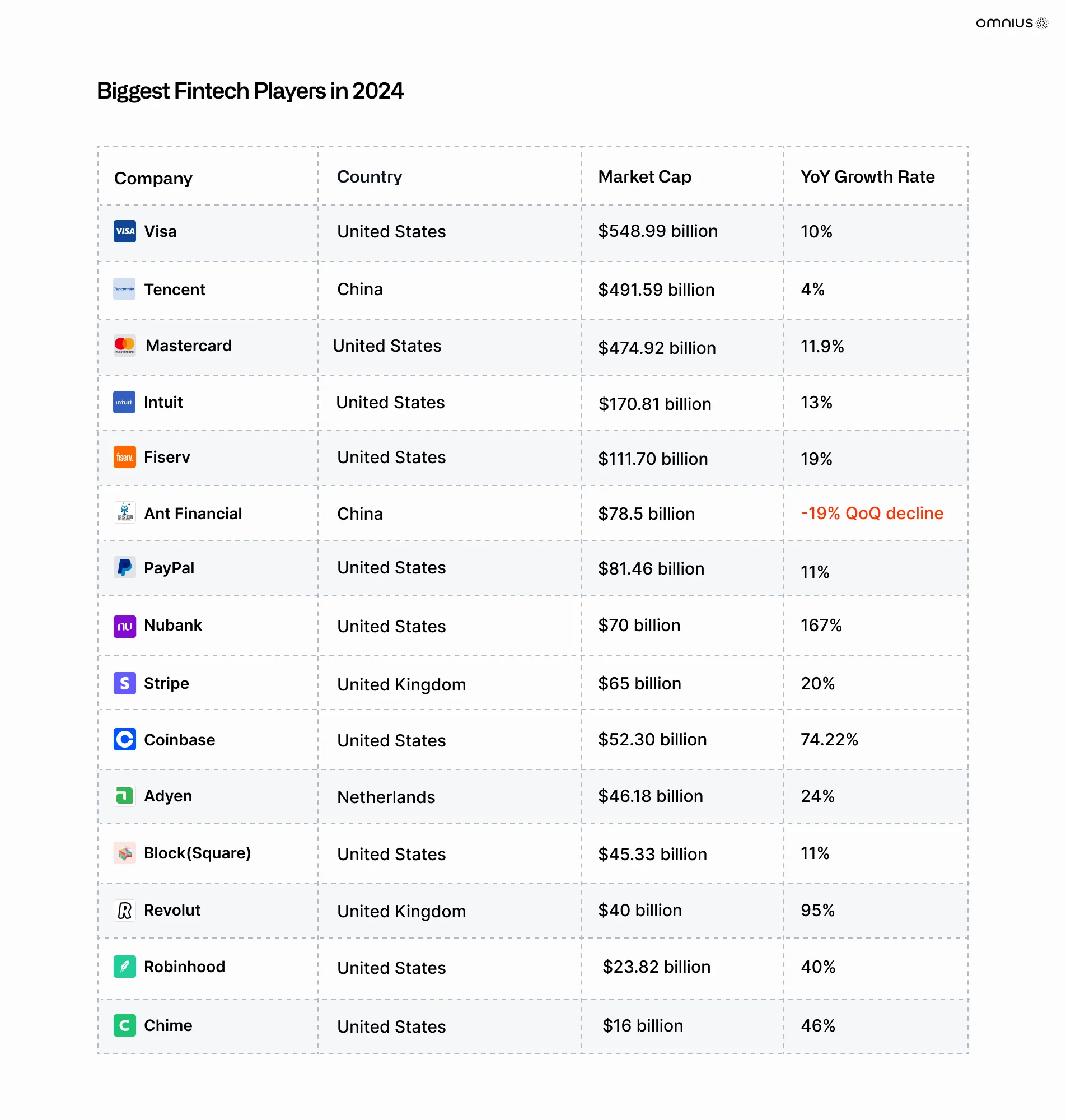

Here are the biggest Fintech companies of 2024:

- Visa (United States) – Market Cap: $548.99 billion | Growth: 10% YoY growth rate

- Tencent (China) – Market Cap: $491.59 billion | Growth: 4% YoY growth rate

- Mastercard (United States) – Market Cap: $474.92 billion | Growth: 11.9% YoY growth

- Intuit (United States) – Market Cap: $170.81 billion | Growth: 13% YoY growth

- Fiserv (United States) – Market Cap: $111.70 billion | Growth: 19% YoY growth

- Ant Financial (China) – Market Cap: $78.5 billion | Growth: -19% QoQ decline

- PayPal (United States) – Market Cap: $81.46 billion | Growth: 11% YoY growth

- Nubank (United States) – Market Cap: $70 billion | Growth: 167% YoY growth

- Stripe (United Kingdom) – Market Cap: $65 billion | Growth: 20% YoY growth

- Coinbase (United States) – Market Cap: $52.30 billion | Growth: 74.22% YoY growth

- Adyen (Netherlands) – Market Cap: $46.18 billion | Growth: 24% YoY growth

- Block(Square) (United States) – Market Cap: $45.33 billion | Growth: 11% YoY growth

- Revolut (United Kingdom) – Market Cap: $40 billion | Growth: 95% YoY growth

- Robinhood (United States) – Market Cap: $23.82 billion | Growth: 40% YoY growth

- Chime (United States) – Market Cap: $16 billion | Growth: 46% YoY growth

4. Fastest Growing Fintech Startups and Companies in 2024

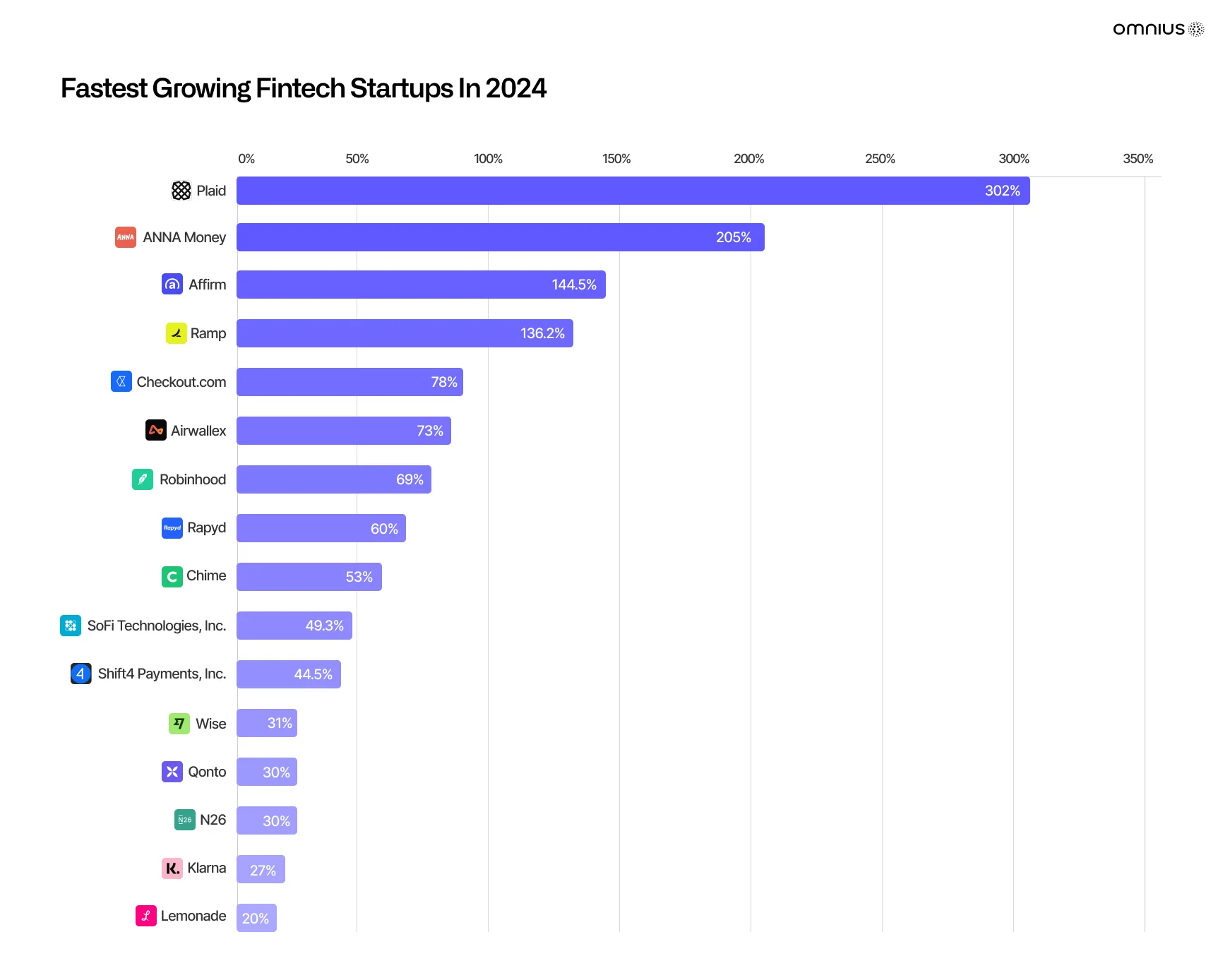

Several fintech firms have emerged as leaders through innovation and strategic expansion during the previous years and are continuing to dominate their niche throughout this year:

- Plaid (United States) – Growth Rate: 302% YoY growth

- Anna Money (United Kingdom) – Growth Rate: 205% YoY growth

- Affirm (United States) – Growth Rate: 141.55% YoY growth

- Ramp (United States) – Growth Rate: 136% YoY growth

- Checkout.com (United Kingdom) – Growth Rate: 78% YoY growth

- Airwallex (Singapore) – Growth Rate: 73% YoY growth

- Robinhood (United States) – Growth Rate: 69% YoY growth

- Rapyd (United Kingdom) – Growth Rate: 60% YoY growth

- Chime (United States) – Growth Rate: 53% YoY growth

- SoFi Technologies, Inc. (United States) – Growth Rate: 49.29% YoY growth

- Shift4 Payments, Inc. (United States) – Growth Rate: 44.52% YoY growth

- Wise (United Kingdom) – Growth Rate: 31% YoY growth

- Qonto (France) – Growth Rate: 30% customers’ YoY growth

- N26 (Germany) – Growth Rate: 30% YoY growth

- Klarna (Sweden) – Growth Rate: 27% Growth in the first half of the year

- Lemonade (United States) – Growth Rate: 20% YoY growth

5. Biggest Fintech Categories (Current and on the Rise)

In 2024, the fintech industry is characterized by several major categories, each with distinct growth trajectories and market shares.

Here’s an overview of the biggest fintech categories segmented as follows:

- By Technology:

- Artificial Intelligence

- Cyber Security

- Biometrics & Identity Management

- Blockchain

- Public Cloud Infrastructure

- Cryptography

- Others

- By Services:

- Insurance

- Payments & Fund Transfer

- Personal Finance

- Wealth Management

- Digital Lending & Lending Market Places Cryptocurrencies

- Digital Investment

- Marketplace Lending

- Online Crowdfunding

- P2P Lending

- Others

- By Providers:

- Securities Brokerages & Investment Firms

- Payment Processor

- Banks

- Non-banking Financial Companies

- Others

Take a closer look at how the fintech adoption rates were changed across different fintech categories within the five countries:

6. Fastest Growing Fintech Categories In 2024

Certain Fintech categories stood out for their exceptional growth in 2024, with AI-powered solutions, data analytics, and finance automation leading the pack.

These categories are expected to grow in the coming years, driven by increasing demand for advanced technologies and industry-specific solutions.

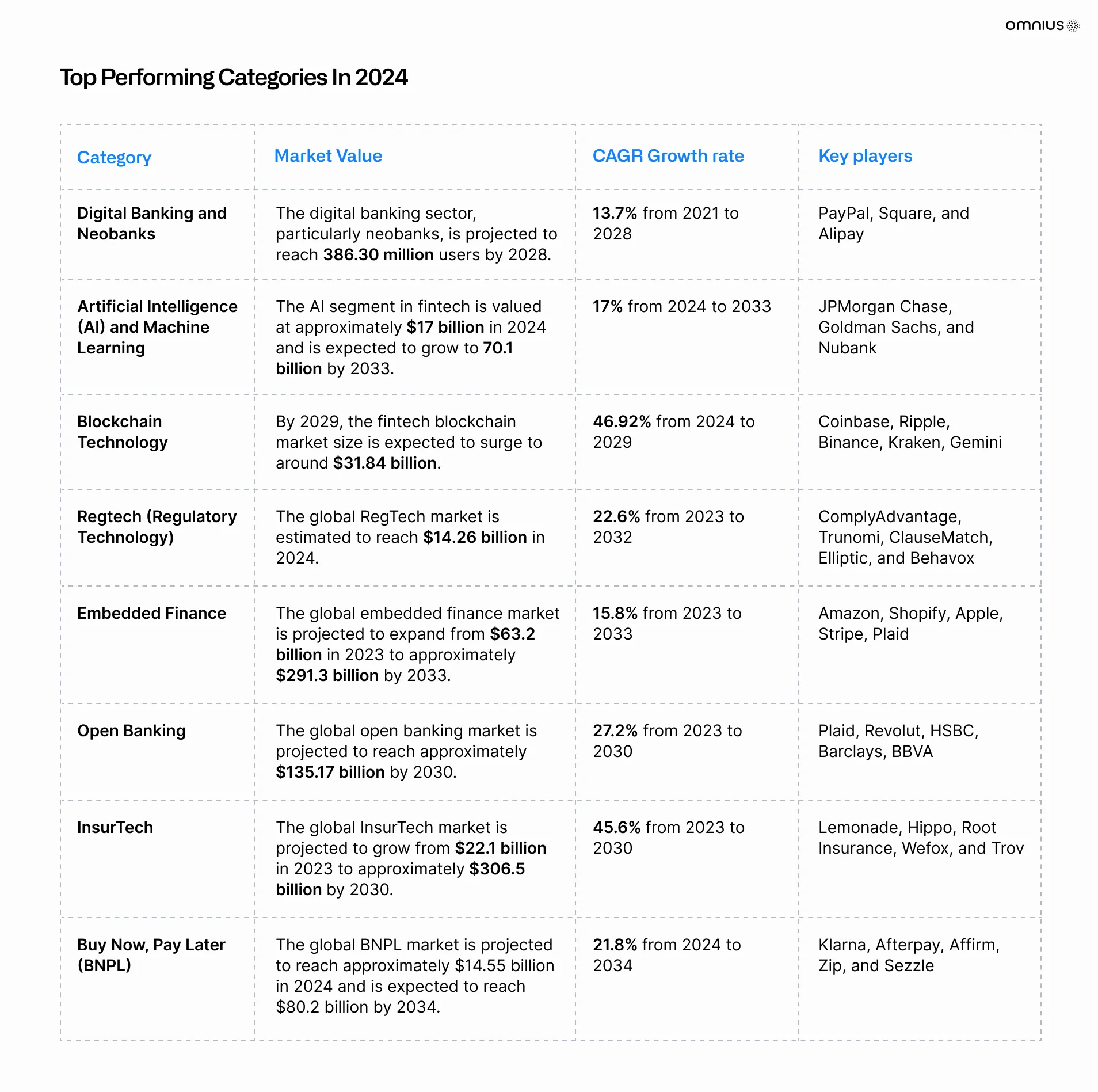

Here are the top-performing categories in 2024:

1. Digital Banking and Neobanks

- Market Value: The digital banking sector, particularly neobanks, is projected to reach 386.30 million users by 2028.

- CAGR Growth rate: 13.7% from 2021 to 2028

- Key Players: PayPal, Square, and Alipay

2. Artificial Intelligence (AI) and Machine Learning

- Market Value: The AI segment in fintech is valued at approximately $17 billion in 2024 and is expected to grow to 70.1 billion by 2033.

- CAGR Growth rate: 17% from 2024 to 2033.

- Key Players: JPMorgan Chase, Goldman Sachs, and Nubank

3. Blockchain Technology

- Market Value: By 2029, the fintech blockchain market size is expected to surge to around $31.84 billion.

- CAGR Growth rate: 46.92% from 2024 to 2029

- Key Players: Coinbase, Ripple, Binance, Kraken, Gemini

4. Regtech (Regulatory Technology)

- Market Value: The global RegTech market is estimated to reach $14.26 billion in 2024.

- CAGR Growth rate: 22.6% from 2023 to 2032

- Key Players: ComplyAdvantage, Trunomi, ClauseMatch, Elliptic, and Behavox

5. Embedded Finance

- Market Value: The global embedded finance market is projected to expand from $63.2 billion in 2023 to approximately $291.3 billion by 2033.

- CAGR Growth rate: 15.8% from 2023 to 2033

- Key Players: Amazon, Shopify, Apple, Stripe, Plaid

6. Open Banking

- Market Value: The global open banking market is projected to reach approximately $135.17 billion by 2030.

- CAGR Growth rate: CAGR of 27.2% from 2023 to 2030.

- Key Players: Plaid, Revolut, HSBC, Barclays, BBVA

7. InsurTech

- Market Value: The global InsurTech market is projected to grow from $22.1 billion in 2023 to approximately $306.5 billion by 2030.

- CAGR Growth rate: 45.6% from 2023 to 2030.

- Key Players: Lemonade, Hippo, Root Insurance, Wefox, and Trov

8. Buy Now, Pay Later (BNPL)

- Market Value: The global BNPL market is projected to reach approximately $14.55 billion in 2024 and is expected to reach $80.2 billion by 2034.

- CAGR Growth rate: 21.8% from 2024 to 2034

- Key Players: Klarna, Afterpay, Affirm, Zip, and Sezzle.

7. Fintech Biggest Investments In 2024

With more than $350 billion of venture capital (VC) funding invested since 2015, fintech has become an industry.

Global net revenue exceeded $150 billion in 2023 and is expected to grow to $400 billion by 2028.

Obtaining VC funding, however, remains a challenge for many fintech companies across regions.

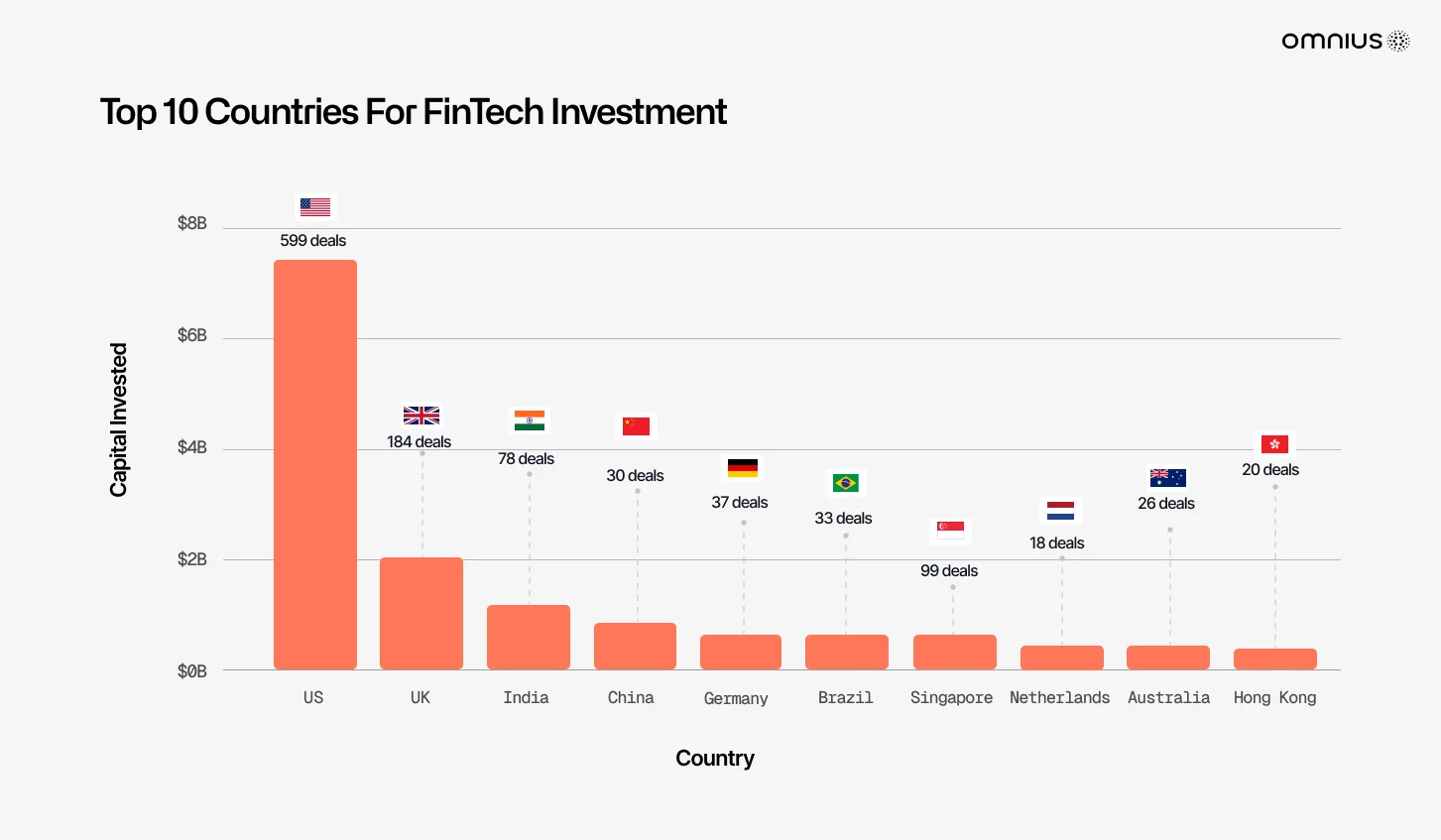

Across global markets, the top 10 destinations for FinTech investment in H1 2024 are similar to the 2023 investments:

However, with all those factors, fintech continues to attract massive investments, fueling innovation and expansion across the sector.

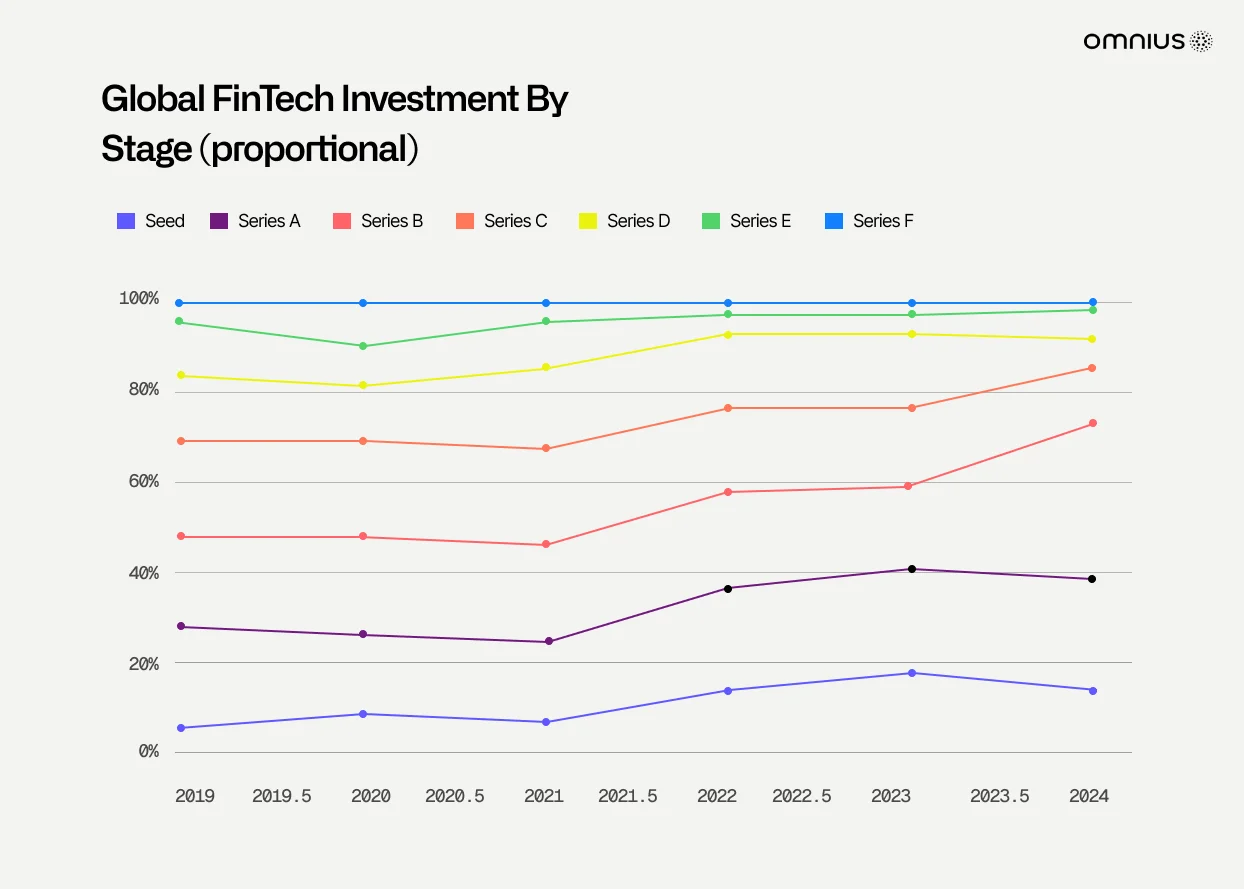

Here is an overview of investments series’ that businesses are getting throughout the years, with Series B businesses getting larger cut during 2023.

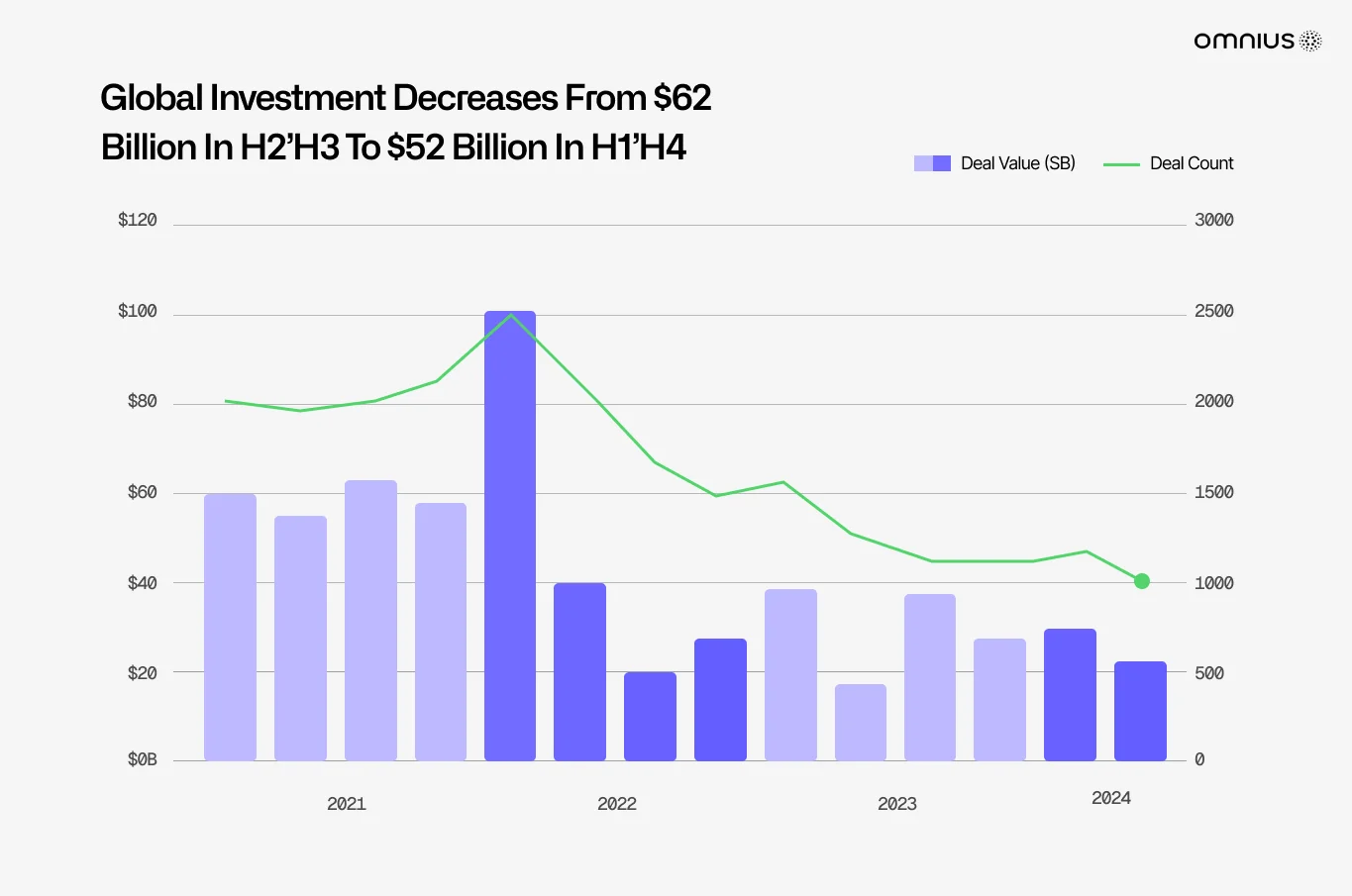

Did you know that global investments decreased from $62 billion in H2’23 to $52 billion in H1’24?

There were different factors impacting investments:

- High interest rates

- Continued inflation

- Geopolitical concerns

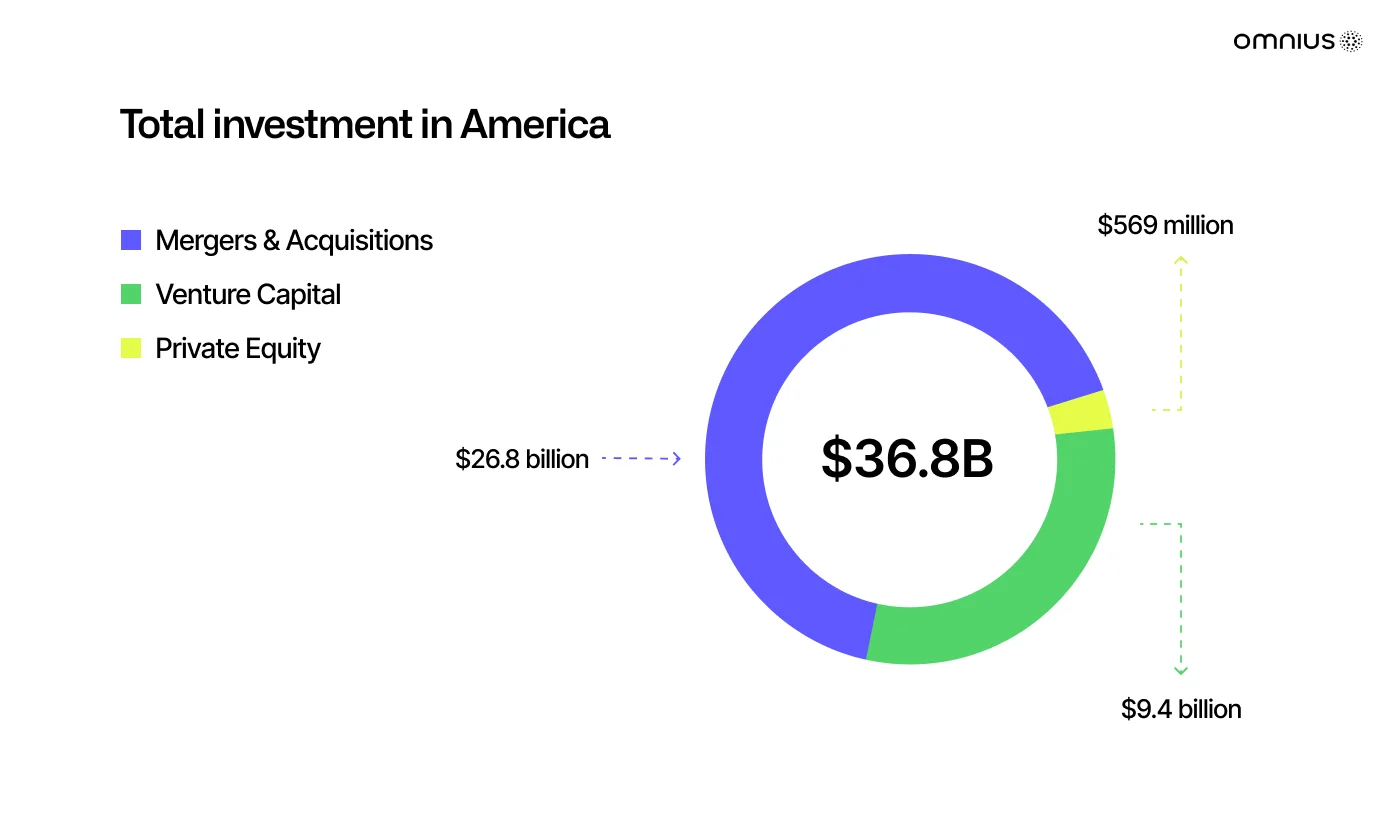

Total investment in America decreased from $38.6 billion in H2’23 to $36.8 billion in H1’24, consisting of:

- Venture Capital – $9.4 billion

- Private Equity – $569 million

- Mergers & Acquisitions – $26.8 billion

These are the biggest FinTech investments in 2024 in America so far:

- WorldPay (US) – Funding: $12.5 billion

- Nuvei (Canada) – Funding: $6.3 billion

- EngageSmart(US) – Funding: $4 billion

- PlusGrade (Canada) – Funding: $1 billion

- Tegus (US) – Funding: $930 million

- Clear Street (US) – Funding: $685 million

- Cadre (US)- Funding: $500 million

- Corvus (US)- Funding: $427 million

- Spiff (US) – Funding: $419 million

- PayJoy (US) – Funding: $360 million

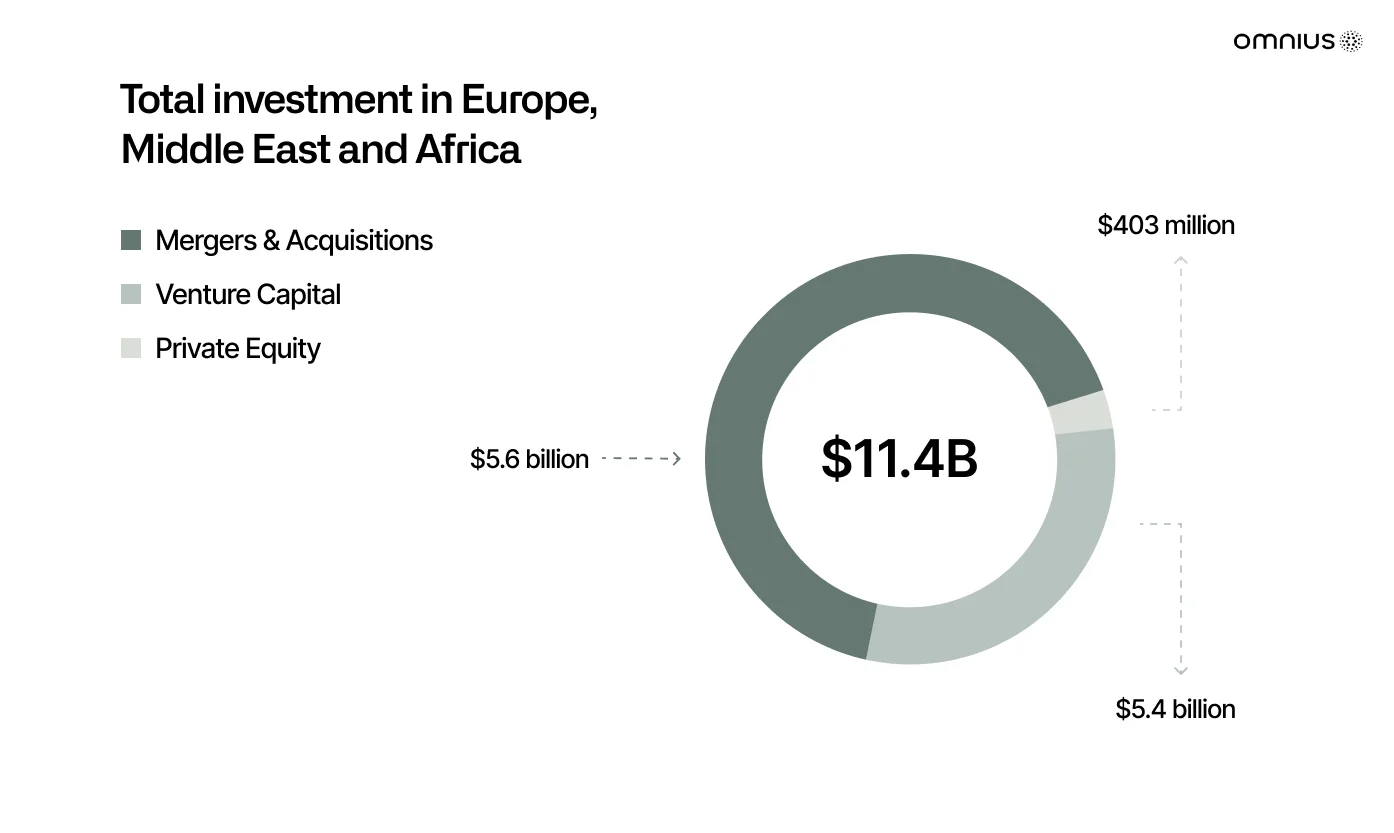

When it comes to Europe, Middle East & Africa, the total investment decreased from $19.2 billion in H2’23 to $11.4 billion in H1’24, consisting of:

- Venture Capital – $5.4 billion

- Private Equity – $403 million

- Mergers & Acquisitions – $5.6 billion

Here are the biggest FinTech investments in 2024 in Europe, Middle East & Africa so far:

- IRIS Software Group (UK) – Funding: $4 billion

- Abound (UK) – Funding: $1 billion

- Banco BPM Gruppo (Italy) – Funding: $653 million

- Monzo (UK) – Funding: $621 million

- Pagero (Sweden) -Funding: $429 million

- Flagstone (UK) – Funding: $175 million

- Pliant (Germany) – Funding: $163 million

- Revolut (UK) – Funding: $139 million

- Voxel (Spain) – Funding: $128 million

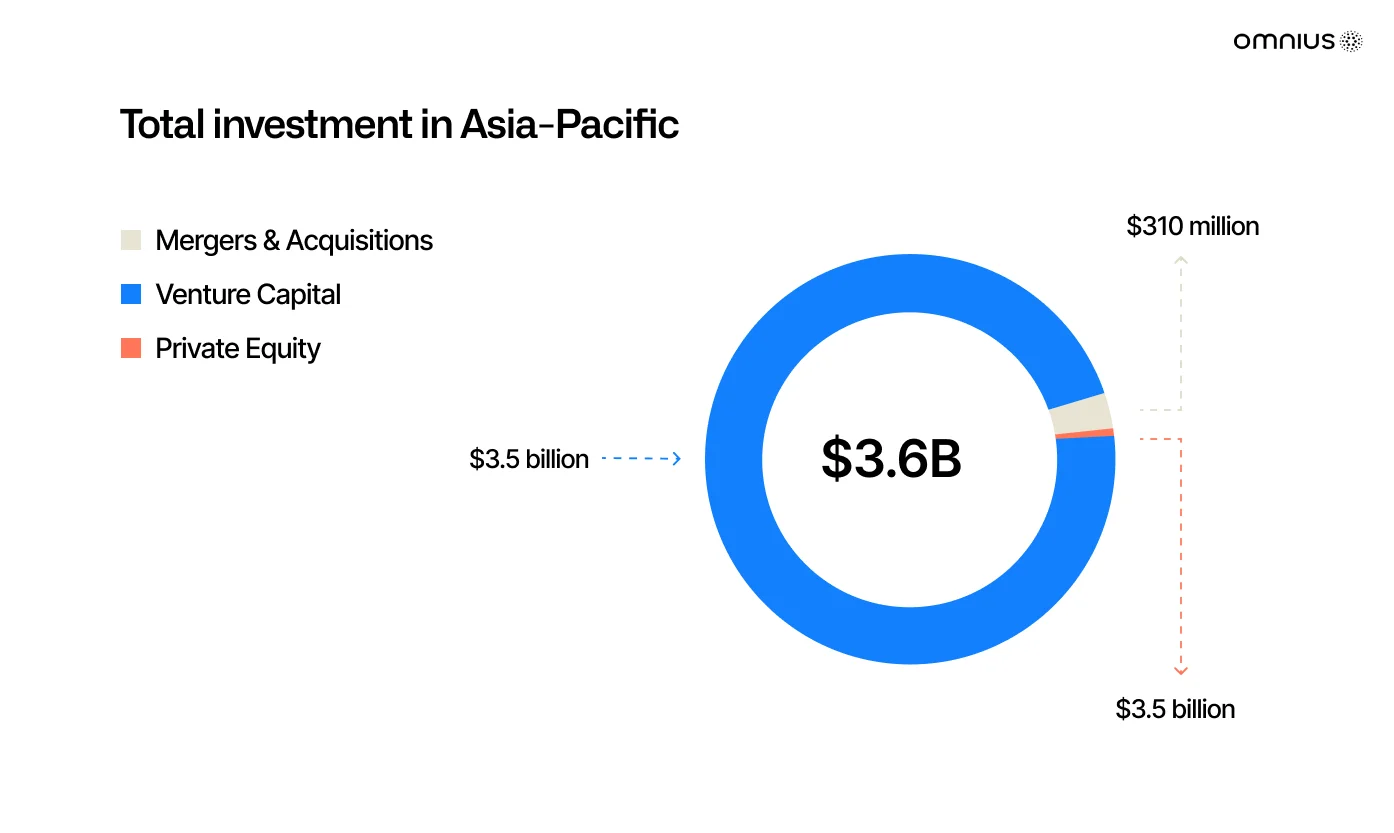

Regarding Asia-Pacific, it’s following the trend, and here, the total investment decreased from $4.6 billion in H2’23 to $3.6 billion in H1’24, consisting of:

- Venture Capital – $3.5 billion

- Private Equity – $8 million

- Mergers & Acquisitions – $310 million

Here are the biggest FinTech investments in 2024 in Asia-Pacific so far:

- Yi’an Enterprise (China) – Funding: $281 million

- Ascend (Thailand) – Funding: $195 million

- MioTech (China) – Funding: $150 million

- Camms (Australia) – Funding: $150 million

- Bridgit (Australia) – Funding: $140 million

- Hashkey Group (China) – Funding: $100 million

- LongBridge Security (China) – Funding: $100 million

- SwiftyLabs (India) – Funding: $100 million

- Guosheng Inclusive Finance (China) – Funding: $90 million

- Fibe (India) – Funding: $90 million

8. Fintech Marketing Trends and Stats in 2024

Fintech marketing strategies are evolving, with a strong emphasis on digital channels and personalized experiences.

Companies increasingly utilize data analytics to tailor their offerings and improve customer engagement.

In 2024, several effective marketing strategies have emerged among fintech firms:

1. Content Marketing

Educating consumers about complex financial products is becoming a priority.

Most of the top performing companies started establishing authority through blogs and educational content which helps them use the power of product-led content to drive new users.

Approximately 96% of the top 100 fintech companies report that content marketing is a key part of their marketing strategy.

This highlights the industry’s recognition of content marketing as essential for building brand awareness, engaging customers, and establishing authority in the niche.

Examples include Wealthfront, Acorns, Chime, Coinbase, and Plaid.

For example, Mint’s financial literacy campaign, in partnership with EVERFI, has successfully reached approximately 1.2 million students through its Prosperity Hub School District program.

Check out how SoFi did that by educating their audience:

2. Personalized Experiences

Firms like Acorns utilize machine learning to tailor user experiences, increasing user engagement by 25%.

This enhancement focuses on personalizing interactions and optimizing the investment process, making it more engaging and accessible for users.

The strategic use of machine learning helps Acorns provide customized recommendations and insights, fostering a deeper connection with its user base.

This type of data-driven marketing enables hyper-personalized experiences, making consumers more likely to engage with brands offering personalized services.

3. Social Media Engagement

Engaging potential customers through platforms like Instagram and TikTok is on the rise, particularly among younger demographics.

Fintech startups are leveraging social media to build brand awareness and reach new audiences.

Other fintech companies, such as Bibit and BukuWarung, have successfully used TikTok to optimize their advertising costs.

For instance, Bibit increased registrations by 414% while reducing its cost per registration by 10.51% by using targeted ads on the platform.

4. Influencer Partnerships

Leveraging influencers to build brand credibility, especially in the millennial and Gen Z demographics.

Revolut, Cash App, Robinhood, SoFi, Venmo, and Nuvei have successfully utilized this strategy.

Here’s an example of an interesting Nuvei campaign with Ryan Reynolds, who also became one of their investors:

9. Geographical Fintech Segmentation and Data Insights

In 2024, geographical fintech segmentation and data reveal significant insights into the banking revenue landscape across different regions.

Here are the key highlights:

1. Transaction Banking Revenue

The world’s ten largest transaction banks experienced a 25% YoY increase in revenue, reaching approximately $47.3 billion in 2023.

This growth was largely driven by rising interest rates, which boosted cash management revenues.

2. Regional Performance

- Asia-Pacific – This region recorded the strongest revenue increase of 36% in 2023, highlighting its growing significance in the global fintech industry.

- North America and Europe – These regions also saw substantial contributions to overall banking revenues, although specific growth percentages were not detailed.

3. Revenue Share

In Q2 2024, global banking’s share of overall group revenues was reported at 12.2%, indicating a stable contribution to total revenues despite fluctuations in interest rates and market conditions.

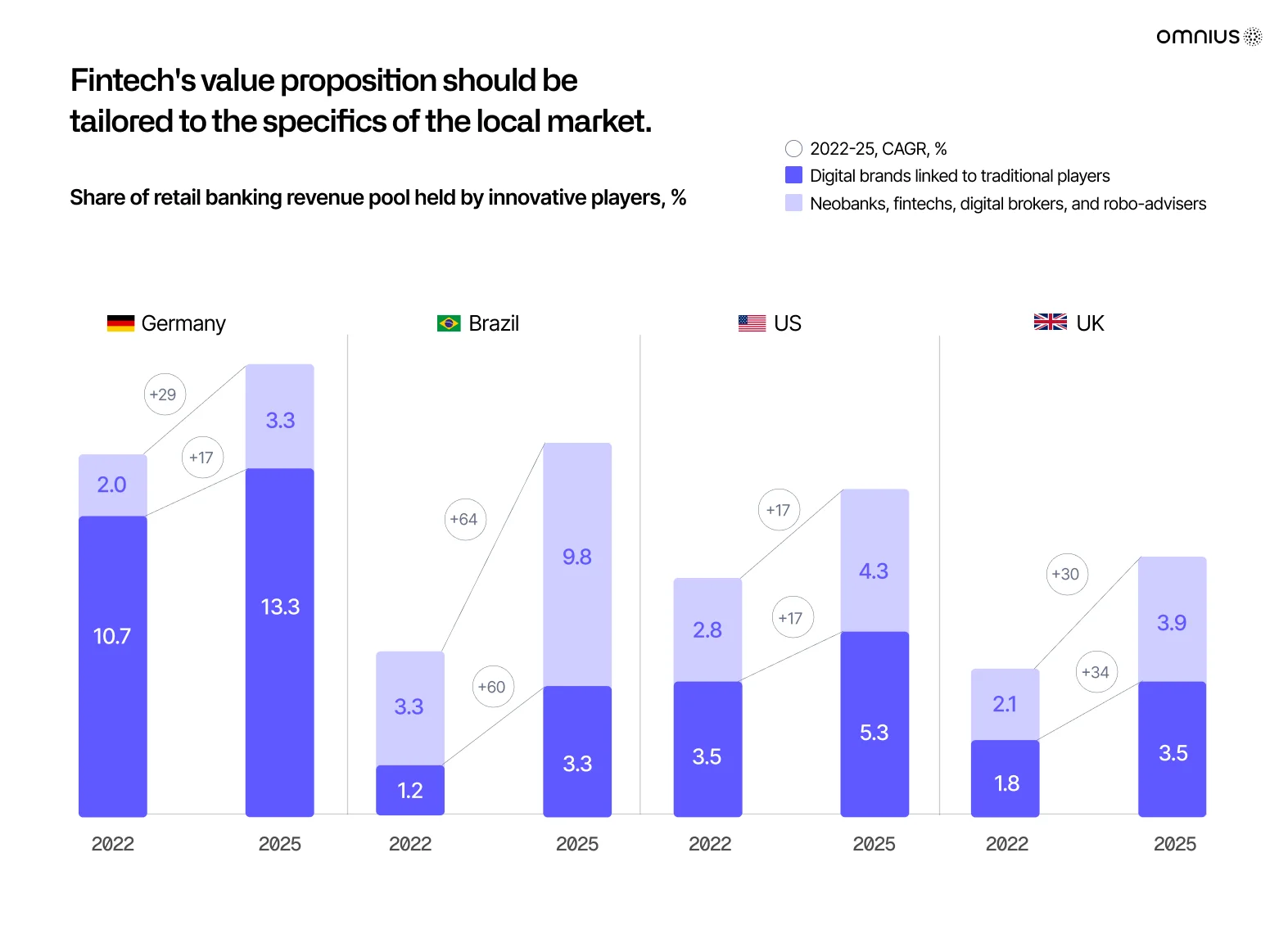

Here’s how the share of revenue was predicted to grow from 2022 to 2025 based on two main categories:

The geographical segmentation of fintech indicates robust growth in transaction banking, particularly in Asia-Pacific, while North America and Europe maintain substantial shares of overall banking revenue.

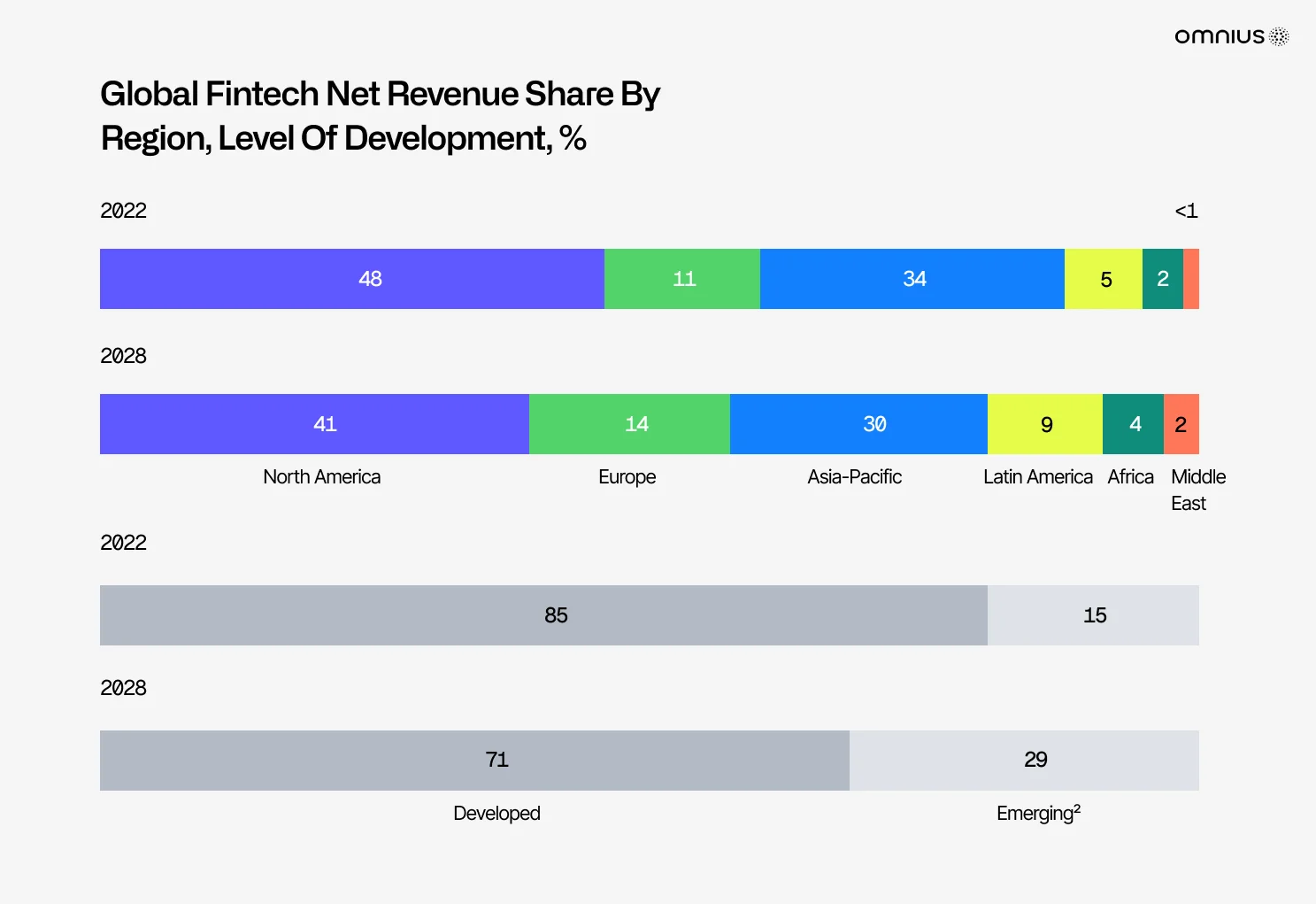

Here’s how it is predicted to change from 2022 to 2028 through different regions, and based on the level of development:

As interest rates stabilize, the sector is poised for further evolution, with banks adapting their strategies to maintain competitive advantages in a changing industry.

Conclusion

As we move through 2024, the fintech industry is positioned for both challenges and opportunities.

With a focus on sustainable growth, regulatory compliance, and technological innovation, the sector is set to continue its transformative impact on the financial services landscape. Stakeholders must adapt to rapidly changing consumer preferences, regulatory pressures, and technological advancements.

With insights from this report, firms can better anticipate market shifts and position themselves for future success in the digital finance revolution.

To simplify this path, we started Omnius – to help you make the best decisions for your business and grow faster at a lower cost.

Contact us to learn how we can help you create a comprehensive content strategy and prepare for significant growth in 2025.

Sources:

- Statista, McKinsey & Company, European Central Bank, Crunchbase, Business Insider, Gartner, Forbes, Fortune Business Insights, YahooFinance, TABInsights, Fintech Futures

Nguồn: omnius.so