We’ve made a list of the top 50 up-and-coming European Fintech software companies in 2025.

Europe’s fintech landscape is maturing quickly, with emerging players carving out specialized niches across digital banking, embedded finance, payments, and compliance. A new generation of startups is pushing the boundaries with modular infrastructure, API-first platforms, and region-specific strategies.

This list brings together a selection of European fintech startups that are not only attracting capital but also reshaping how financial services are being built and consumed – often from the ground up.

Let’s dive in.

1. Adyen

Industry: Financial Technology (Fintech)

Adyen is a Dutch payment company that provides a unified platform for businesses to accept online, mobile, and point-of-sale payments.

Location: Amsterdam, Netherlands

Founded: 2006

Last Funding Round: Initial Public Offering (IPO), June 2018

Total Funding: Approximately $250 million raised in 2014

Valuation: Approximately $50.8 billion as of February 2025

Number of Users: Serves thousands of businesses globally

Growth Rate: 24% year-over-year net revenue growth in the first half of 2024

Key Features

Online payments, Point-of-sale solutions, Unified commerce, Risk management, Authentication, Issuing services, Data insights, Financial management, Global acquiring, Multi-currency support

2. Revoult

Industry: Financial Technology (Fintech)

Revolut is a global financial superapp offering a range of digital banking services, including payments, investing, and budgeting tools, all within a single mobile platform.

Location: London, England

Founded: 2015

Last Funding Round: Series E in July 2021, led by SoftBank and Tiger Global

Total Funding: Approximately $1.7 billion

Valuation: $45 billion as of August 2024; some shareholders are reportedly seeking a $60 billion valuation in early 2025

Number of Users: 50 million globally as of November 2024; projected to exceed 67 million by December 2025

Growth Rate: Added over 10 million users in 2024; aiming for 100 million users by 2030

Key Features

Multi-currency accounts, International money transfers, Debit and credit cards, Stock and crypto trading, Savings vaults, Budgeting tools, Insurance, Personal loans, Peer-to-peer payments, Buy Now Pay Later (BNPL), Premium subscriptions like Revolut Ultra

3. Checkout.com

Industry: Financial Technology (Fintech)

Checkout.com is a global digital payments platform that provides enterprises with end-to-end payment solutions, including online payment acceptance, fraud prevention, and data analytics. The company enables businesses to process payments in multiple currencies with advanced customization and control.

Location: London, England

Founded: 2009

Last Funding Round: Series D in January 2022, raised $1 billion

Total Funding: Approximately $1.8 billion

Valuation: Peaked at $40 billion in 2022; reduced to $9.3 billion as of June 2023 due to market corrections

Number of Users: Used by over 18,000 merchants globally

Growth Rate: 45% year-over-year net revenue growth in 2024; targeting 30% growth in 2025

Key Features

Payment processing in 150+ currencies, Direct acquiring in key global markets, AI-powered Intelligent Acceptance, Modular and customizable APIs, Fraud detection tools, Real-time data reporting, Same-day settlements, Business accounts with expense and Cash flow management

4. Klarna

Industry: Financial Technology (Fintech)

Klarna is a Swedish fintech company specializing in online financial services, including payment processing and Buy Now, Pay Later (BNPL) solutions. It offers consumers flexible payment options and provides merchants with tools to enhance the shopping experience.

Location: Stockholm, Sweden

Founded: 2005

Last Funding Round: July 2022, raising $800 million

Total Funding: Approximately $3.7 billion

Valuation: Targeting a $15–$20 billion valuation in its planned 2025 IPO, down from a peak of $45.6 billion in 2021

Number of Users: Over 150 million active users globally as of early 2025

Growth Rate: Revenue grew 24% year-over-year, reaching $2.81 billion in 2024

Key Features

Buy Now, Pay Later (BNPL) services, Interest-free installment payments, Klarna Card for in-store purchases, Klarna App with shopping and budgeting tools, Loyalty rewards program, Partnerships with major retailers like Walmart, Nike, and Sephora

5. Rapyd

Industry: Fintech / Payments Infrastructure

Rapyd is a global fintech-as-a-service platform that enables businesses to integrate a broad range of financial services into their applications. It supports local and cross-border payments, offering digital wallets, card issuing, compliance, treasury services, and more through a unified API.

Location: London, United Kingdom

Founded: 2016

Last Funding Round: August 2021 – Raised $300 million in Series E

Total Funding: Approximately $960 million

Valuation: Estimated at $15 billion as of March 2022

Number of Users: Serves around 12,000 small and medium-sized businesses and approximately 650 enterprise clients

Growth Rate: Payment volume exceeded $20 billion in 2021, showing significant year-over-year growth

Key Features

Global payment acceptance, Cross-border payouts, Digital wallets, Card issuing, Compliance and KYC services, Fraud protection, Treasury management, API-based integration, Support for over 1,200 payment methods in more than 100 countries

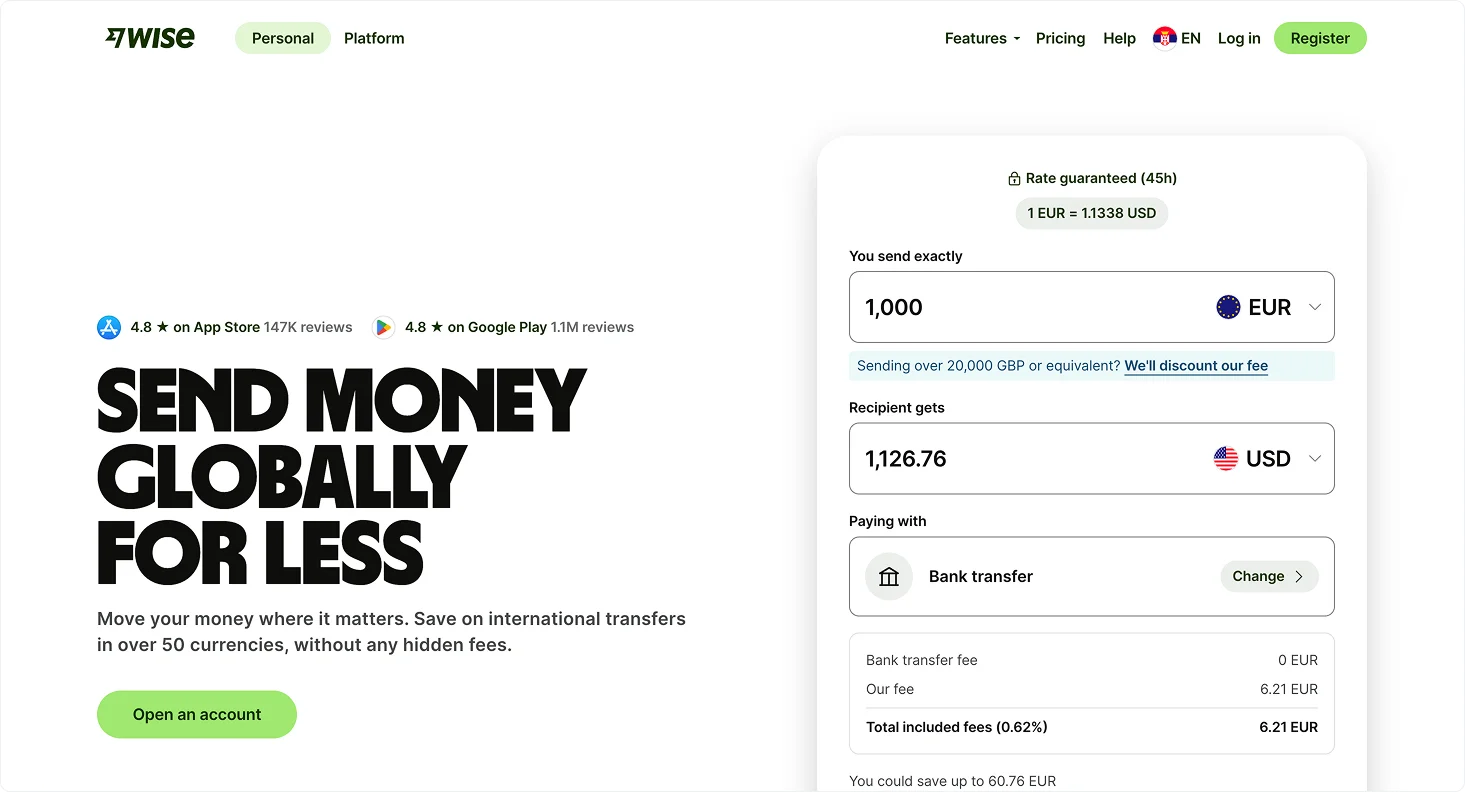

6. Wise

Industry: Financial Technology (Fintech)

Wise is a UK-based financial technology company specializing in international money transfers. Founded in 2011, it provides services like multi-currency accounts, debit cards, and business accounts, allowing individuals and businesses to manage finances across borders with low fees.

Location: London, United Kingdom

Founded: 2011

Last Funding Round: Direct listing on the London Stock Exchange, July 2021

Total Funding: Over $1 billion

Valuation: $11 billion (at time of direct listing, July 2021)

Number of Users: Over 10 million active customers (as of 2024)

Growth Rate: 46.5% increase in revenue in 2024, reaching $1.8 billion

Key Features

Multi-currency accounts, International money transfers, Debit cards, Business accounts, Investment products, Currency exchange, Bill splitting, Budgeting tools, Instant notifications, Fee-free foreign transactions

7. N26

Industry: Financial Technology (Fintech)

N26 is a Berlin-based neobank offering fully digital, mobile-first banking services. It provides personal and business accounts, debit cards, budgeting tools, and investment features, operating under a full German banking license.

Location: Berlin, Germany

Founded: 2013

Last Funding Round: Series E in October 2021, raising over $900 million

Total Funding: Approximately $1.8 billion

Valuation: Peaked at over $9 billion in 2021; reportedly reduced to around €3 billion (~$3.2 billion) by late 2023

Number of Users: 4.8 million revenue-generating customers as of December 2024

Growth Rate: 40% revenue growth in 2024 (€440 million); projected 30–40% growth in 2025

Key Features

Mobile-only banking, Personal and business accounts, Debit cards, Budgeting tools, Investment accounts, Cryptocurrency trading, Real-time transaction notifications, and Spaces for savings goals

8. SumUp

Industry: Financial Technology (Fintech)

SumUp is a global fintech company providing mobile point-of-sale (mPOS) solutions and financial services tailored for small and micro businesses. Its offerings include card readers, payment processing, business accounts, and invoicing tools, aiming to simplify commerce for merchants worldwide.

Location: London, United Kingdom

Founded: 2012

Last Funding Round: December 2023, raised €285 million (~$307 million) led by Sixth Street Growth

Total Funding: Approximately $1.5 billion

Valuation: Over $8.5 billion as of December 2023; potential valuation near $9 billion in a planned share sale

Number of Users: Supports over 4 million merchants across 36 markets

Growth Rate: In 2024, surpassed 1 billion transactions annually; over 1 million users adopted SumUp Business Account, indicating strong multi-product engagement

Key Features

Mobile card readers, Payment processing in multiple currencies, Business accounts, Invoicing tools, E-commerce integrations, Customer loyalty programs, and Financial analytics

9. Shift4

Industry: Fintech / Payment Processing / Commerce Technology

Shift4 is a financial technology company offering integrated payment processing and technology solutions. It provides software providers with a single integration to an end-to-end payments offering, including a powerful gateway and a robust suite of technology solutions such as cloud enablement, business intelligence, analytics, and mobile capabilities.

Location: Headquartered in Allentown, Pennsylvania, United States

Founded: 1999 (as United Bank Card); rebranded to Shift4 Payments in 2017

Last Funding Round: Initial Public Offering (IPO) on June 5, 2020, raising $345 million

Total Funding: Approximately $345 million (from IPO)

Valuation: Market capitalization of approximately $6.7 billion as of April 14 2025

Number of Users: Processes payments for over 200.000 businesses

Growth Rate: 29.86% year-over-year, increasing from $2.565 billion in 2023 to $3.331 billion in 2024

Key Features

Integrated payment processing, Point-of-sale (POS) systems, E-commerce solutions (Shift4Shop), Mobile payment technology, Cloud-based reporting and analytics, Support for various payment methods including credit, debit, contactless, and mobile wallets

10. Mollie

Industry: Fintech – Online Payments

Mollie is a leading European payment service provider offering a simple, secure, and developer-friendly platform for businesses to accept online payments. It supports a wide range of local and international payment methods and serves over 250,000 businesses across Europe.

Location: Amsterdam, Netherlands

Founded: 2004

Last Funding Round: Series C, June 22, 2021, €665 million

Total Funding: €864 million (~$928 million)

Valuation: $6.5 billion

Number of Users: Over 250,000 businesses

Growth Rate: As of 2021, Mollie was adding approximately 400–500 new customers daily, reflecting significant growth.

Key Features

Effortless payments, Seamless checkout, Multiple payment methods, Powerful integrations, Fast and flexible financing, Robust security, Advanced dashboard and app

11. Monzo

Industry: Financial Technology (Fintech)

Monzo is a UK-based digital bank offering mobile-first personal and business banking services. It provides current accounts, savings, lending products, and budgeting tools, operating under a full UK banking license.

Location: London, England

Founded: 2015

Last Funding Round: October 2024, employee share sale valuing the company at $5.9 billion

Total Funding: Approximately $1.1 billion

Valuation: $5.9 billion as of October 2024

Number of Users: Over 11 million customers globally as of March 2025

Growth Rate: Achieved first annual profit of £15.4 million in 2024, with revenue doubling to £880 million; customer base increased by over 1.7 million during the year

Key Features

Mobile banking app, Personal and business current accounts, Savings pots, Overdrafts and loans, Instant spending notifications, Budgeting tools, Monzo Plus and Premium subscriptions, Integration with third-party financial services, and International money transfers

12. Airwallex

Industry: Fintech / Cross-Border Payments & Financial Infrastructure

Airwallex is a global fintech company that provides cross-border payment solutions and financial infrastructure for businesses. Its platform offers multi-currency business accounts, international payments, expense management, and embedded finance solutions, enabling companies to operate seamlessly across borders.

Location: Founded in Melbourne, Australia; currently headquartered in Singapore, with operations in over 130 countries

Founded: 2015

Last Funding Round: March 11 2023 – Raised $200 million in Series F funding

Total Funding: Approximately $1.1 billion over 12 rounds

Valuation: Approximately $5.6 billion as of 2023

Number of Users: Serves over 100000 businesses globally

Growth Rate: Reported a 70% year-over-year growth rate in 2025

Key Features

Multi-currency business accounts, International payments, Expense management, Embedded finance solutions, Integrations with platforms like Xero and QuickBooks, and partnerships with companies such as McLaren Racing

13. Trade Republic

Industry: Financial Technology (Fintech)

Trade Republic is a German neobank offering commission-free trading and investment services through its mobile app, focusing on stocks, ETFs, derivatives, and cryptocurrencies.

Location: Berlin, Germany

Founded: 2015

Last Funding Round: Series C, June 2022

Total Funding: $1.255 billion

Valuation: $5.4 billion (2022)

Number of Users: 8 million (as of January 2025)

Growth Rate: Doubled customer base in 2024

Key Features

Commission-free trading, Investment in stocks, ETFs, derivatives, and cryptocurrencies, Mobile app platform, Cash deposits with interest, Debit card services, Savings plans, Tax-advantaged investment accounts

14. ANNA Money

Industry: Fintech / Neobank / SME Financial Services

ANNA Money is a UK-based fintech company offering a business account and tax app for small businesses and freelancers. Services include invoicing, receipt management, bank reconciliation, and tax calculations.

Location: Cardiff, Wales, United Kingdom

Founded: 2017

Last Funding Round: Angel – II, March 6, 2023 – $2.7 million

Total Funding: Approximately $46.1 million over 6 rounds

Valuation: Estimated between $67 million and $110 million as of May 2020

Number of Users: Over 100,000 small businesses and freelancers

Growth Rate: Achieved a 140.10% annual sales growth over three years

Key Features

AI-powered invoicing, Expense management, Bookkeeping, Tax calculations, Business debit Mastercard, Mobile app interface, Real-time notifications, Integration with accounting software

15. Qonto

Industry: Fintech / Business Banking

Qonto is a European fintech company offering digital financial services tailored for small and medium-sized enterprises (SMEs), freelancers, and entrepreneurs. Its platform provides business accounts, expense management, invoicing, and integrations with accounting tools, aiming to streamline financial operations for businesses.

Location: Paris, France

Founded: 2016

Last Funding Round: January 2022 – Raised €486 million in Series D

Total Funding: Approximately $709 million

Valuation: Estimated at €5 billion as of late 2024

Number of Users: Over 500,000 SMEs and freelancers across Europe

Growth Rate: Expanded into Austria, Belgium, the Netherlands, and Portugal in 2024; acquired German fintech Penta in 2022

Key Features

Business current accounts, Physical and virtual debit cards, Expense management, Invoicing tools, Multi-user access with customizable permissions, Itegrations with accounting software, Real-time transaction tracking, International transfers

16. Viva Wallet

Industry: Fintech / Digital Payments & Neobanking

Viva Wallet is a European cloud-based neobank and payment service provider offering a unified payments platform for businesses. It provides services such as card acceptance, business accounts with local IBANs, debit card issuance, and payment processing through its proprietary infrastructure.

Location: Marousi, Greece

Founded: 2010

Last Funding Round: January 2022 – JPMorgan acquired a 48.5% stake for €800 million

Total Funding: Approximately €800 million

Valuation: Estimated at €5 billion

Number of Users: Not publicly disclosed; serves businesses across 24 European countries

Growth Rate: Viva Wallet has experienced significant growth, expanding its services across Europe and achieving unicorn status in 2022.

Key Features

Cloud-based payments platform, Card acceptance (physical and online), Business accounts with local IBANs, Debit card issuance, Tap-to-pay technology, Expense management tools

17. Wefox

Industry: Insurtech (Digital Insurance Services)

Wefox is a Swiss-based digital insurance company founded in 2015. It operates a platform connecting insurance companies with brokers and customers, offering a range of insurance products through a digital interface.

Location: Zürich, Switzerland

Founded: 2015

Last Funding Round: July 2022 – Raised $400 million in Series D funding

Total Funding: Over $1.4 billion

Valuation: $4.5 billion as of July 2022

Number of Users: Over 2 million customers as of mid-2022

Growth Rate: Revenue increased from $320 million in 2021 to $587 million in 2022

Key Features

Digital insurance platform, Broker management system, AI-based risk assessment, Personalized insurance policies, Multi-channel distribution, Policy automation

18. Bitpanda

Industry: Fintech (Digital Asset Trading – Investment Platform)

Bitpanda is an Austrian fintech company founded in 2014, offering a platform for trading cryptocurrencies, stocks, ETFs, precious metals, and commodities. It aims to make investing accessible to everyone through a user-friendly interface and a wide range of financial products.

Location: Vienna, Austria

Founded: 2014

Last Funding Round: August 2021 – Raised $263 million in Series C funding

Total Funding: Approximately $497.1 million over 3 rounds

Valuation: Over $4 billion as of August 2021

Number of Users: Over 6 million

Growth Rate: Revenue increased from $98.66 million in 2022 to $161.81 million in 2023

Key Features

Cryptocurrency trading, Precious metals trading, Stocks and ETFs, Bitpanda card, Savings plans, Asset-backed tokens, Wallet services, Regulated in the EU

19. OakNorth

Industry: Financial Technology (Fintech)

OakNorth Bank is a UK-based digital bank that specializes in providing business loans and savings accounts. Founded in 2015, the bank focuses on serving small and medium-sized enterprises (SMEs) with loans ranging from £0.5 million to £25 million.

Location: London, United Kingdom

Founded: 2015

Last Funding Round: Series C, February 2019

Total Funding: $440 million raised in February 2019

Valuation: $2.8 billion at the time of the Series C funding round in February 2019

Number of Users: Over 10,000 businesses financed since inception

Growth Rate: Significant growth from 2015 to 2023, with over £10 billion lent to businesses across the UK

Key Features

Business loans ranging from £0.5 million to £25 million, Fixed-term savings accounts, Easy-access savings accounts, Cash ISAs, Business current accounts, Foreign exchange services, Payment processing solutions

20. GoCardless

Industry: Fintech / Payments

GoCardless is a UK-based fintech company that enables account-to-account payments. It allows businesses to collect recurring and one-off payments directly from customers’ bank accounts, streamlining billing, subscriptions, and invoice payments.

Location: London, United Kingdom

Founded: 2011

Last Funding Round: February 2022 – Raised $312 million in Series G funding

Total Funding: Approximately $540 million

Valuation: $2.1 billion as of 2022

Number of Users: Over 65,000 businesses globally

Growth Rate: Revenue grew from £55.3 million in FY 2021 to £70.4 million in FY 2022

Key Features

Direct debit payments, Instant bank payments, Recurring billing, International payments, Payment tracking, API integration, Fraud prevention, Open banking support

21. Raisin

Industry: Fintech / Savings & Investment Marketplace

Raisin is a Berlin-based fintech company that operates a pan-European digital marketplace for savings and investment products. It connects retail customers with banks seeking to expand their deposit reach, enabling savers to access competitive interest rates across borders.

Location: Berlin, Germany

Founded: 2012

Last Funding Round: March 2023 – Raised €60 million in Series E

Total Funding: Approximately $272 million

Valuation: As of December 3, 2024, Raisin’s valuation exceeded €2 billion

Number of Users: Over 1.5 million customers

Growth Rate: Raisin reported revenues of €158 million in 2023, nearly doubling from the previous year.

Key Features

Cross-border savings and investment marketplace, Partnerships with over 400 banks in more than 30 countries, Access to high-yield savings products, ETF-based investment and pension products

22. Meniga

Industry: Financial Software (Digital Banking, Personal Finance Management)

Meniga is a fintech company that provides digital banking solutions, including personal finance management, data enrichment, and customer engagement tools. It serves over 100 million banking customers across 30 countries, partnering with major financial institutions to enhance their digital offerings.

Location: Headquartered in London, UK, with offices in Reykjavík, Iceland, and Warsaw, Poland.

Founded: 2009

Last Funding Round: Series D, €15 million (~$16.17 million) in December 2023, led by Groupe BPCE, Crédito Agrícola, and Omega ehf.

Total Funding: Approximately $72.82 million over 13 rounds

Valuation: Not publicly disclosed.

Number of Users: Serving over 100 million banking customers across 30 countries

Growth Rate: Reported increases include a 49% rise in monthly active users, 200% more time spent in-app, 24% more app sessions, 70% increase in new product uptake, and a 50% reduction in cost per acquisition.

Key Features

Personal Finance Management (PFM), Data Enrichment, Hyper-Personalised Insights, Cashflow Forecasting, Smart Savings, Open Banking Capabilities, Sustainability Tracking, Customer Engagement Tools, Gamified Digital Banking Experiences

23. Bunq

Industry: Financial Technology (Fintech)

Bunq is a Dutch neobank offering a range of financial services through its mobile app, including current accounts, savings accounts, debit cards, and investment products. Founded in 2012, Bunq has expanded its operations across Europe, providing users with a user-friendly platform for managing personal and business finances.

Location: Amsterdam, Netherlands

Founded: 2012

Last Funding Round: Series A, 2021

Total Funding: €1.6 billion

Valuation: €1.8 billion as of 2023

Number of Users: 12.5 million customers as of June 2024

Growth Rate: 11% increase in user base from 2023 to 2024

Key Features

Mobile banking, Current accounts, Savings accounts, Debit cards, Investment products, Multi-currency accounts, Joint accounts, Budgeting tools, Instant payments, 24/7 customer support

24. Pleo

Industry: Financial Technology (Fintech)

Pleo is a Danish fintech company that offers a smart spend management platform for businesses. It provides physical and virtual company cards, along with an intuitive mobile app, to streamline expense tracking, automate reporting, and enhance financial oversight for teams.

Location: Copenhagen, Denmark

Founded: 2015

Last Funding Round: July 2021, raised $150 million in a Series C round, led by Bain Capital Ventures and Thrive Capital

Total Funding: Approximately $228.8 million as of July 2021

Valuation: $1.7 billion as of July 2021

Number of Users: Over 37,000 companies across Europe

Growth Rate: Achieved unicorn status in July 2021, becoming Denmark’s fastest startup to reach a $1 billion valuation, with a significant increase in user base and funding since its inception

Key Features

Smart company cards (physical and virtual), Automated expense reporting, Real-time spending insights, Multi-level approval workflows, Integration with accounting software, Receipt capture via mobile app

25. Trustly

Industry: Fintech / Open Banking Payments

Trustly is a Swedish fintech company specializing in open banking payment solutions. It enables consumers to make payments directly from their bank accounts, bypassing traditional card networks. The company’s platform supports real-time processing, bookkeeping, and account reconciliation for mobile devices and cross-border payments.

Location: Headquartered in Stockholm, Sweden, with operations in Europe, North America, and Australia

Founded: 2008

Last Funding Round: Acquired by Nordic Capital in March 2018 for $862 million

Total Funding: Approximately $28.7 million over 3 rounds

Valuation: Estimated at $1.61 billion as of December 2019

Number of Users: Over 112 million consumers globally

Growth Rate: In 2023, Trustly processed $58 billion in transactions, a 79% increase from the previous year. The company also reported revenues of $265 million, marking a 14% year-over-year growth.

Key Features

Account-to-account payment platform, Real-time processing, Support for 12,000 banks, Connections with 650 million consumers, Cross-border payments, Integration with major brands like PayPal and eBay, and Compliance with European and U.S. financial regulations.

26. Solarisbank

Industry: Banking-as-a-Service (BaaS) / Fintech

Solaris is a Berlin-based fintech company offering a modular Banking-as-a-Service platform. It enables businesses to embed financial services such as accounts, cards, lending, and identity verification directly into their digital products through APIs.

Location: Berlin, Germany

Founded: 2016

Last Funding Round: March 2024 – Raised $145 million

Total Funding: Approximately $698 million

Valuation: Estimated at $1.6 billion

Number of Users: Not publicly disclosed; 1.1 million ADAC credit cards were migrated to Solaris in 2024

Growth Rate: Revenue reached €146 million in FY 2022

Key Features

Banking-as-a-Service APIs, Digital accounts, Card issuing, Lending services, KYC/AML compliance, Embedded finance, Real-time data access, Multicurrency support

27. Wayflyer

Industry: Financial Technology (Fintech), Revenue-Based Financing for eCommerce

Wayflyer provides non-dilutive revenue-based financing and data-driven analytics to help eCommerce businesses access working capital, optimize cash flow, and scale efficiently.

Location: Dublin, Ireland, with offices in London, New York, and Sydney

Founded: 2019

Last Funding Round: Series B, February 2022, $150 million led by DST Global and QED Investors

Total Funding: Over $676 million including equity and debt financing

Valuation: $1.6 billion post-Series B in February 2022

Number of Users: Over 5.000 eCommerce brands globally

Growth Rate: 900% YoY increase in cash advances in 2021, €62.5 million revenue in 2023 up from €36.33 million in 2022

Key Features

Revenue-based financing with no equity dilution, Daily analytics for marketing and performance, Self-serve funding access, Amazon and wholesale financing, Expanded operations across 11 countries, Scalable funding up to $20 million per brand

28. Ebury

Industry: Fintech / Cross-Border Payments & FX Risk Management

Ebury is a London-based fintech company specializing in international payments, foreign exchange (FX) risk management, and business lending solutions tailored for small and medium-sized enterprises (SMEs). The platform facilitates transactions in over 130 currencies, offering services such as currency hedging, trade finance, and mass payments.

Location: Headquartered in London, United Kingdom; operates 31 offices across 21 countries

Founded: 2009

Last Funding Round: December 28, 2023 – Series C, raised $1.91 million

Total Funding: Approximately $374 million

Valuation: Estimated at $1.52 billion as of December 2023

Number of Users: Serves over 17.000 businesses

Growth Rate: Ebury has experienced significant growth, expanding its workforce to over 1,600 employees across 29 countries. The company reported £204 million in revenue for the fiscal year ending April 2023.

Key Features

International payments in 130+ currencies, FX risk management tools, Business lending solutions, Trade finance services, Mass payment capabilities, and a Proprietary platform designed for SMEs and mid-sized companies

29. Starling Bank

Industry: Financial Technology (Fintech)

Starling Bank is a UK-based digital challenger bank offering personal and business banking services through its mobile app. Founded in 2014, it provides current accounts, savings accounts, business accounts, and euro accounts.

Location: London, United Kingdom

Founded: 2014

Last Funding Round: Series C, February 2019

Total Funding: £233 million as of July 2019

Valuation: £1.5 billion (at time of Series C funding in February 2019)

Number of Users: 3.6 million customers as of 2023

Growth Rate: Significant growth from 43,000 customers in 2017 to 3.6 million in 2023

Key Features

Personal current accounts, Joint accounts, Business accounts, Euro accounts, Savings accounts, Bills Manager, Spaces (sub-accounts for budgeting), Virtual cards, Mobile cheque deposits, 24/7 customer support

30. Funding Circle

Industry: Financial Technology (Fintech)

Funding Circle is a UK-based commercial lender specializing in providing business financing solutions. Founded in 2010, the company offers a platform where businesses can access loans directly from investors, facilitating the growth of small and medium-sized enterprises (SMEs).

Location: London, United Kingdom

Founded: 2010

Last Funding Round: Secondary share sale, October 2024

Total Funding: Over £300 million raised during the initial public offering (IPO) in 2018

Valuation: Approximately £1.5 billion at the time of the IPO in 2018

Number of Users: Over 100,000 businesses financed since 2010

Growth Rate: Facilitated over £13 billion in credit to SMEs as of June 2024

Key Features

Business loans ranging from £10,000 to £500,000, Loan terms from six months to six years, FlexiPay line of credit product in the UK, Marketplace connecting borrowers with lenders offering various products

31. Payhawk

Industry: Fintech / Spend Management

Payhawk is a fintech company offering a spend management platform that combines corporate cards, expense reimbursements, accounts payable, and accounting integrations into a unified system. The platform enables businesses to control and automate their spending processes across multiple entities and countries.

Location: London, United Kingdom

Founded: 2018

Last Funding Round: March 2022 – Raised $100 million in a Series B extension

Total Funding: Approximately $239 million over 5 rounds

Valuation: Estimated at $1 billion as of March 2022

Number of Users: Not publicly disclosed; serves customers in over 32 countries

Growth Rate: Payhawk has expanded its services across Europe and the US, operating in multiple countries and serving a growing customer base.

Key Features

Corporate Visa and Mastercard cards, Real-time expense tracking, Automated invoice processing, Multi-entity and multi-currency support, Accounting software integrations, Mobile and web applications

32. Zopa

Industry: Financial Services (Digital Banking – Consumer Lending)

Zopa is a UK-based digital bank that started in 2005 as the world’s first peer-to-peer lending platform. In 2020, it transitioned to a full banking model, offering personal loans, credit cards, savings accounts, and a money management app.

Location: London, United Kingdom

Founded: 2005

Last Funding Round: December 2024 – Raised $87 million in equity funding

Total Funding: Approximately $792.3 million

Valuation: Estimated at $1 billion

Number of Users: Over 1.3 million

Growth Rate: Approximate 3% year-over-year employee growth, with around 719 employees

Key Features

Personal loans, Credit cards, Savings accounts, Money management app, Current accounts, AI-driven customer service tools, Open Banking integration

33. Tink

Industry: Financial Technology (Fintech)

Tink is a Swedish open banking platform that provides banks, fintechs, and startups with access to financial data, analytics, and payment services.

Location: Stockholm, Sweden

Founded: 2012

Last Funding Round: April 2021, raised $47.9 million in a Series D round

Total Funding: Approximately $359 million over multiple funding rounds

Valuation: $800 million as of December 2020

Number of Users: Tink connects to over 2,500 banks, reaching more than 250 million bank customers across Europe

Growth Rate: Specific percentage growth figures are not publicly disclosed; however, Tink has expanded its services to 20 European markets and established 13,000 connections to financial institutions, indicating significant growth since its inception

Key Features

Open banking APIs, Financial data aggregation, Payment initiation services, Transaction data enrichment, Personal finance management tools

34. Agicap

Industry: Financial Software (Treasury Management)

Agicap is a SaaS company that provides cash flow management and forecasting software for small and medium-sized businesses. It enables real-time tracking, forecasting, and optimization of liquidity through integrations with banks and ERPs.

Location: Lyon, France

Founded: 2016

Last Funding Round: Series C, €45M ($48M) in November 2024

Total Funding: Approximately $167M–$185M

Valuation: Estimated between €700M–€800M ($750M–$860M) as of late 2024

Number of Users: Over 8,000 companies (primarily in Europe)

Growth Rate: 7× revenue growth since 2021; reached cash-flow break-even in Europe by early 2025

Key Features

Cash flow monitoring & forecasting, Bank & ERP integrations, Accounts payable & receivable automation, Liquidity planning, Debt & investment management, Spend management, Custom dashboards, Mobile app

35. TrueLayer

Industry: Fintech / Open Banking Payments

TrueLayer is a UK-based fintech company specializing in open banking payment solutions. It enables businesses to offer instant bank payments by connecting to consumers’ bank accounts, bypassing traditional card networks. The platform supports real-time processing, financial data access, and identity verification, facilitating seamless online transactions.

Location: Headquartered in London, United Kingdom; operations across Europe

Founded: 2016

Last Funding Round: October 2024 – Raised $50 million in a Series E extension

Total Funding: Approximately $322 million

Valuation: Estimated at $700 million as of October 2024 down from $1 billion in 2021

Number of Users: Over 10 million users across 21 European countries

Growth Rate: Processes over $50 billion in payments annually, handling 150 million transactions and one million variable recurring payment transactions each month

Key Features

Account-to-account payments, Real-time processing, Support for 12,000 banks, Integration with major brands like PayPal and eBay, Compliance with European and U.S. financial regulations

36. Tide

Industry: Fintech / Business Banking

Tide is a UK-based fintech company offering digital banking services designed specifically for small and medium-sized enterprises (SMEs). Its platform includes business current accounts, expense management tools, invoicing, and integrations with major accounting systems.

Location: London, United Kingdom

Founded: 2015

Last Funding Round: July 2021 – Raised $100 million in Series C

Total Funding: Approximately $200 million

Valuation: Estimated at around $650 million

Number of Users: Over 500,000 SMEs

Growth Rate: Doubled its user base in under two years leading up to 2023; consistently expanding market share in UK SME banking

Key Features

Business current accounts, Expense tracking, Invoicing tools, Company registration, Integration with accounting software, Credit and funding, Automated bookkeeping

37. Monese

Industry: Fintech / Digital Banking

Monese is a UK-based fintech company offering mobile-only banking services, including current accounts and money transfer services, as an alternative to traditional banks. The platform provides accounts in Pounds sterling, Euros, and Romanian leu, and is available in 31 countries across the European Economic Area.

Location: London, United Kingdom

Founded: 2013

Last Funding Round: May 2024 – Series C (undisclosed amount)

Total Funding: Approximately $269 million

Valuation: Estimated at $536 million as of April 2025

Number of Users: Over 2 million customers across more than 30 countries

Growth Rate: Monese has experienced significant growth since its inception, expanding its services across the European Economic Area.

Key Features

Mobile-only current accounts, Multi-currency support (GBP, EUR, RON), Instant account opening without credit checks or residency requirements, International money transfers, Budgeting tools, Integration with accounting software

38. Onfido

Industry: Identity Verification / AI / Fintech

Onfido is a technology company that enables businesses to verify the identity of users using a government-issued photo ID and facial biometrics, powered by artificial intelligence. It supports secure and scalable onboarding for digital services.

Location: London, United Kingdom

Founded: 2012

Last Funding Round: April 2020 – Raised $105 million in Series D

Total Funding: Approximately $242 million

Valuation: Estimated at $479 million as of mid-2021

Number of Users: Not publicly disclosed; Trusted by 1000+ global businesses

Growth Rate: Revenue reached £94.5 million in FY 2022, showing continued year-over-year growth

Key Features

Identity verification, Document verification, Facial biometrics, AI fraud detection, KYC compliance, Global ID coverage, Onboarding automation

39. Soldo

Industry: Fintech / Spend Management

Soldo is a UK-based fintech company offering a spend management platform that combines prepaid company cards with software for managing business expenses. The platform enables businesses to control and track spending, automate expense reporting, and integrate with accounting systems.

Location: London, United Kingdom

Founded: 2014

Last Funding Round: Series C (date not specified)

Total Funding: Approximately $258 million over 7 rounds

Valuation: Estimated at $278 million

Number of Users: Over 25,000 organizations across 31 countries

Growth Rate: Soldo has expanded its services across Europe, operating in multiple countries and serving a growing customer base.

Key Features

Prepaid company cards, Expense tracking, Automated expense reporting, Integration with accounting software, Real-time spending control, Multi-user accounts, Mobile and web applications

40. Anyfin

Industry: Fintech / Consumer Credit / Debt Refinancing

Anyfin is a Stockholm-based fintech company that offers a platform for refinancing existing consumer loans. Utilizing publicly available consumer data, artificial intelligence tools, and mobile technology, Anyfin enables individuals with good credit ratings to reduce their interest costs on consumer loans by refinancing their original credit without extending the repayment period.

Location: Stockholm, Sweden

Founded: 2017

Last Funding Round: €13.5 million in December 2024 from existing investors

Total Funding: Approximately €110 million.

Valuation: €250 million (pre-money) as of December 2024

Number of Users: Over 1 million app downloads

Growth Rate: 15% average monthly growth in active customers since March 2021; fivefold growth in 2022

Key Features

AI-powered loan refinancing, Interest rate reduction, Debt consolidation, Credit score monitoring, Financial health tools, Mobile app interface, Support for multiple European markets

41. Railsr (formerly Railsbank)

Industry: Fintech / Embedded Finance / Banking-as-a-Service (BaaS)

Railsr is a London-based fintech company offering an embedded finance platform that enables brands to integrate financial services such as digital wallets, payments, rewards, loyalty points, and cards into their customer experiences. The platform caters to various sectors, including fintech, sports, retail, and more.

Location: London, United Kingdom; with offices across Europe, APAC, and the US.

Founded: 2016

Last Funding Round: October 2022 – Raised $46 million in Series C funding (comprising $26 million in equity and $20 million in debt).

Total Funding: Approximately $233 million over multiple rounds.

Valuation: In October 2022, the company’s valuation declined to approximately $250 million during a Series C funding round.

Number of Users: Serves over 300 business-to-business (B2B) customers and manages 5.5 million accounts.

Growth Rate: Reported a 50% revenue growth in the first half of 2022.

Key Features

Digital wallets, Payments, Rewards, Loyalty points, Cards

42. Yapily

Industry: Fintech / Open Banking Infrastructure

Yapily is a London-based fintech company providing an open banking infrastructure platform. It enables businesses to access financial data and initiate payments by securely connecting to thousands of banks across Europe through a single API. Yapily serves various sectors, including lending, accounting, wealth management, digital banking, payments, and crypto.

Location: London, United Kingdom

Founded: 2017

Last Funding Round: July 2021 – Raised $51 million in Series B funding

Total Funding: Approximately $70.8 million over 5 rounds

Valuation: $231 million as of August 2021

Number of Users: Specific user numbers are not publicly disclosed; 19+ countries

Growth Rate: Specific growth metrics are not publicly disclosed.

Key Features

Account information services, Payment initiation services, Variable recurring payments, Bulk payments, Data enrichment, Account validation, Open banking connectivity, Single API integration

43. Curve

Industry: Fintech / Digital Payments

Curve is a UK-based fintech company that offers a digital wallet platform allowing users to consolidate multiple bank cards and accounts into a single smart card and mobile application. The platform provides features such as real-time spending notifications, expense tracking, and the ability to switch payment sources retroactively.

Location: London, United Kingdom

Founded: 2015

Last Funding Round: March 14, 2025 – Raised $47.9 million in Series C

Total Funding: Approximately $323 million over 13 rounds

Valuation: Estimated at $230 million as of April 2025

Number of Users: Not publicly disclosed; previously reported over 500,000 users in 2019

Growth Rate: In 2023, Curve reported revenues of £26.7 million

Key Features

All-in-one smart card, Mobile app integration, Real-time spending notifications, Expense tracking, Ability to switch payment sources retroactively, Zero foreign transaction fees

44. Plum

Industry: Fintech / Personal Finance / WealthTech

Plum is a smart money management app that uses artificial intelligence and behavioral economics to automate savings and investments. It connects to users’ bank accounts to analyze income and spending patterns, enabling automatic transfers to savings or investment accounts.

Location: London, United Kingdom

Founded: 2016

Last Funding Round: Series B July 23 2024 – $17.3 million

Total Funding: Approximately $75.8 million over 15 rounds

Valuation: Estimated at $194 million as of June 2023

Number of Users: Expanded to over 2 million users across 10 European markets

Growth Rate: Nearly doubled year-on-year, supported by robust subscription streams and a 40% increase in average revenue per customer.

Key Features

AI-driven savings automation, Investment in stocks and ETFs, Budgeting tools, Expense tracking, Financial insights, Integration with bank accounts, Goal setting, Personalized financial recommendations

45. Tandem

Industry: Fintech / Digital Banking

Tandem Bank is a UK-based digital bank offering a range of financial products including savings accounts, mortgages, personal loans, and green home improvement loans. The bank focuses on providing sustainable financial solutions and has expanded its services through strategic acquisitions.

Location: London, United Kingdom

Founded: 2013

Last Funding Round: June 2023 – Raised $25.4 million in Series C

Total Funding: Approximately $309 million

Valuation: Estimated at $132 million as of August 2020

Number of Users: Approximately 800,000 as of March 2020

Growth Rate: Tandem has expanded its services through acquisitions, including Harrods Bank in 2018 and Oplo in 2022, increasing its total assets to £1.2 billion.

Key Features

Digital savings accounts, Personal loans, Green home improvement loans, Mortgages, Mobile banking app, Sustainability-focused financial products, Tandem Marketplace for green living resources

46. Lemonway

Industry: Fintech / Payment Processing

Lemonway is a pan-European payment institution specializing in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The platform offers services such as third-party payment collection, escrow account management, and compliance with KYC/AML regulations.

Location: Paris, France

Founded: 2007

Last Funding Round: October 2019 – Raised €25 million in a Private Equity round

Total Funding: Approximately €44 million over 5 rounds

Valuation: Estimated at €55 million as of July 2018

Number of Users: Over 1,400 platforms, including 200 crowdfunding platforms; 5 million e-wallets opened since December 2012

Growth Rate: In 2023, Lemonway reported a 25% increase in payment volume to €9.6 billion, with revenue doubling to €32 million and achieving an operating profit of €5 million

Key Features

Payment processing for marketplaces and crowdfunding platforms, Wallet management, Third-party payment collection, Escrow account services, Compliance with KYC/AML regulations

47. LendInvest

Industry: Fintech / Mortgage Finance

LendInvest is a UK-based fintech company offering an asset management platform focused on property finance. It provides mortgage products including buy-to-let, bridging, residential, and development loans, serving intermediaries, landlords, and developers.

Location: London, United Kingdom

Founded: 2013

Last Funding Round: July 2021 – Initial Public Offering (IPO) on the London Stock Exchange

Total Funding: Approximately $129 million

Valuation: Around $49.6 million market cap as of April 2025

Number of Users: Not publicly disclosed

Growth Rate: Revenue grew from £46.83 million in 2019 to £105.9 million in 2024

Key Features

Buy-to-let mortgages, Bridging loans, Development finance, Online application process, Proprietary credit technology, Investor platform, Secured lending

48. iwoca

Industry: Fintech / SME Lending

iwoca is a UK-based fintech company specializing in providing flexible financing solutions to small and medium-sized enterprises (SMEs). The platform offers unsecured business loans and credit lines, utilizing machine learning algorithms to assess creditworthiness based on data from various sources, including accounting software and online marketplaces.

Location: London, United Kingdom

Founded: 2011

Last Funding Round: November 2024 – Raised $258.3 million in debt funding

Total Funding: Approximately $495.8 million

Valuation: Not publicly disclosed

Number of Users: Serves over 50.000 businesses

Growth Rate: As of December 2023, iwoca reported a turnover of £142.58 million, marking an 82% increase from the previous year.

Key Features

Unsecured business loans up to £500,000, Credit lines up to £200,000, Rapid online application process, Integration with accounting platforms (e.g., Xero, Sage), Data-driven credit assessments, and Partnerships with platforms like Tide for embedded lending solutions.

49. Swan

Industry: Financial Software (Embedded Banking / Banking-as-a-Service)

Swan is a French fintech company specializing in embedded banking. It enables companies to integrate banking services—such as accounts, cards, and payments—directly into their products via APIs. Swan is a licensed financial institution regulated by the ACPR (Bank of France) and a principal member of Mastercard.

Location: Paris, France

Founded: 2019

Last Funding Round: Series B extension, €42 million (~$44 million) in January 2025, led by Eight Roads Ventures with participation from Lakestar, Accel, Creandum, Hexa, and Bpifrance.

Total Funding: Approximately $108 million over 5 rounds.

Valuation: Not publicly disclosed

Number of Users: Over 150 companies across 30 European countries.

Growth Rate: Reported 250% growth in monthly revenue and transaction volumes since the previous funding round, along with a 370% increase in the number of cards issued.

Key Features

Creation and management of payment accounts with individual IBANs, Issuance of virtual and physical Mastercard cards, compatible with Apple Pay and Google Pay, SEPA transfers and direct debits, Built-in compliance, KYC, and fraud risk management, White-labeled APIs and interfaces for seamless integration, Developer-friendly platform with GraphQL APIs, Self-built core banking system for enhanced control and localization

50. Finom

Industry: Fintech / Digital Banking / Financial Management

Finom is a European fintech company that provides digital banking and financial management services tailored for small and medium-sized enterprises (SMEs), freelancers, and the self-employed. The platform integrates banking, invoicing, expense management, and accounting tools into a single, mobile-first solution.

Location: Amsterdam, Netherlands

Founded: 2019

Last Funding Round: February 2024 – Raised €50 million in a Series B funding round led by General Catalyst and Northzone

Total Funding: Over €100 million since inception

Valuation: Not publicly disclosed

Number of Users: Over 100.000 customers across Europe

Growth Rate: Specific growth rates are not publicly disclosed; however, Finom has demonstrated significant expansion across multiple European markets.

Key Features

Business accounts, Invoicing, Expense management, Accounting integrations, AI-powered accounting agent, Real-time transaction notifications, Card management, Tax compliance tools

Conclusion

What ties these companies together isn’t just sector or stage – it’s momentum.

European fintech is proving that scale and sophistication don’t have to come from Silicon Valley. With regulatory clarity improving and cross-border capital flowing more freely, these startups are well-positioned to become not just European leaders, but global benchmarks.

For businesses seeking to enhance their online presence and drive growth, Omnius offers specialized B2B SaaS SEO and content marketing services designed to elevate brand visibility and engagement.

With a focus on data-driven strategies, we help clients optimize their digital marketing efforts to attract and retain customers effectively.

Ready to take your SaaS business to the next level?

Contact us today to learn how we can help you achieve your growth goals!

Nguồn: omnius.so