In spite of how many tales about founders’ experiences we can see, there are still common myths around the field of startups.

The fact shows that at this moment (late 2023), 90% of new startups fail!

Furthermore, 10% of new startups fail within their first year.

The success percentage of founders of first-time startups is only 18%.

Let’s find out what exactly is hiding behind the stories and myths sparkling around startup profitability!

First, What Is a Startup?

A startup is a business that is still in its early stages of operation.

Startups are usually created by a few business owners, and founders who desire to create goods or services in wide demand.

Usually, they offer high-tech-oriented services or products.

Startups are innovative, fast-growing, flexible, and contain a high risk of failure.

This is one more reason why the profitability of a startup is crucial.

🚀How to Start a Startup?

In every decade, starting any kind of company is demanding.

Startups share the same challenges.

Founders of startups also need to understand many issues as:

- legal, protecting intellectual property & financial and funding,

- marketing & sales,

- risk management & human resources, and others.

Do Startups Have Their Myths?

Like many things in our lives, Startups also own their myths, and here are some of them:

The widespread myth is that startups make worldwide profitable success overnight!

This can not be true!

Amazon started its sales in 1994, which is 30 years ago!

The truth is that every firm and startup needs time to develop and make a profit.

The myth is that you need to have a great idea to get started.

No, you need only that idea that meets the needs of your customers.

What Is Profitability?

Profitability is vital for any firm, especially for startups.

In short, it is a metric that shows if a startup will survive or not nowadays.

It helps you watch and balance your income and costs at the same time.

Profitability is a magical formula that measures for your firm how to select the right business and decisions.

People usually tend to increase the inflow of cash and income, but it is risky if they do not watch their expenses at the same time.

So they should always keep an eye on income/expenses/cash ratios.

Let’s see how profitability works!

What Makes You Profitable?

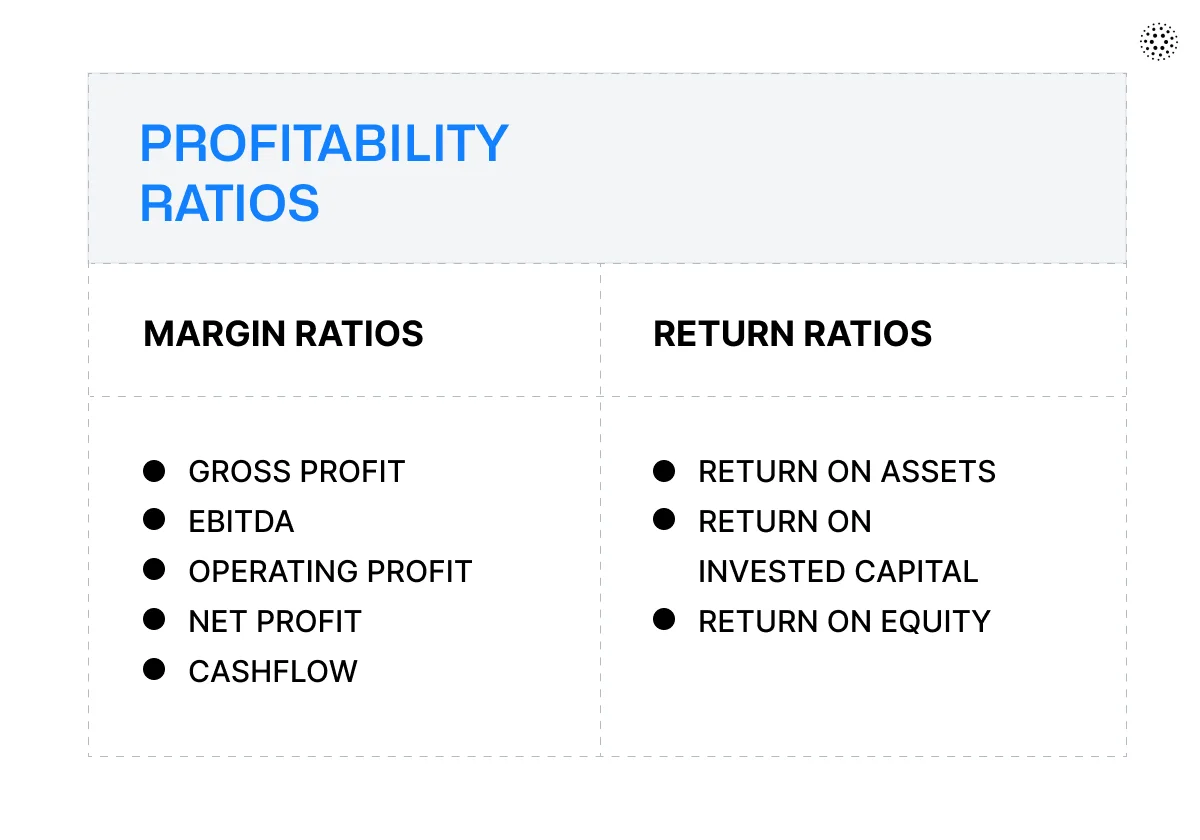

To become profitable, you need to increase your profitability ratios.

Profitability ratios test a company’s ability to create income/earnings relative to its expenses during a certain period.

These ratios show how a corporation uses its capital to generate value for its owners.

Ratios for profitability can determine if a company’s assets provide adequate operating profit.

Profitability is also critical to the company’s solvency.

A greater ratio indicates that the company is doing well on revenues, profitability, and cash flow.

What Are the Margin Ratios?

Margin ratios test a company’s capacity to turn earnings into profits.

They are great in valuation, credit research, and business performance.

But margin ratios are also good for examining the link between earnings and sales.

What Exactly Is a Gross Profit Margin?

Gross profit margin is a financial indicator used by analysts to assess the financial health of a company.

It shows the profit after deducting the cost of goods sold (COGS).

A company’s gross profit margin is the amount of money it makes minus its costs for operating the business.

This measure, also known as the gross margin ratio, appears as a percentage of sales.

The formula for this ratio is:

For example:

Step 1: Your revenue (income) for your painting is 40.000$

Costs are 10.000$ for painting.

Gross profit is: 40.000$ revenue (income) -10.000$ costs = 30.000 Gross profit

Step 2: (30.000$ Gross profit/40.000$ revenue)*100 = 75% Gross profit margin

What Is Net Profit Margin?

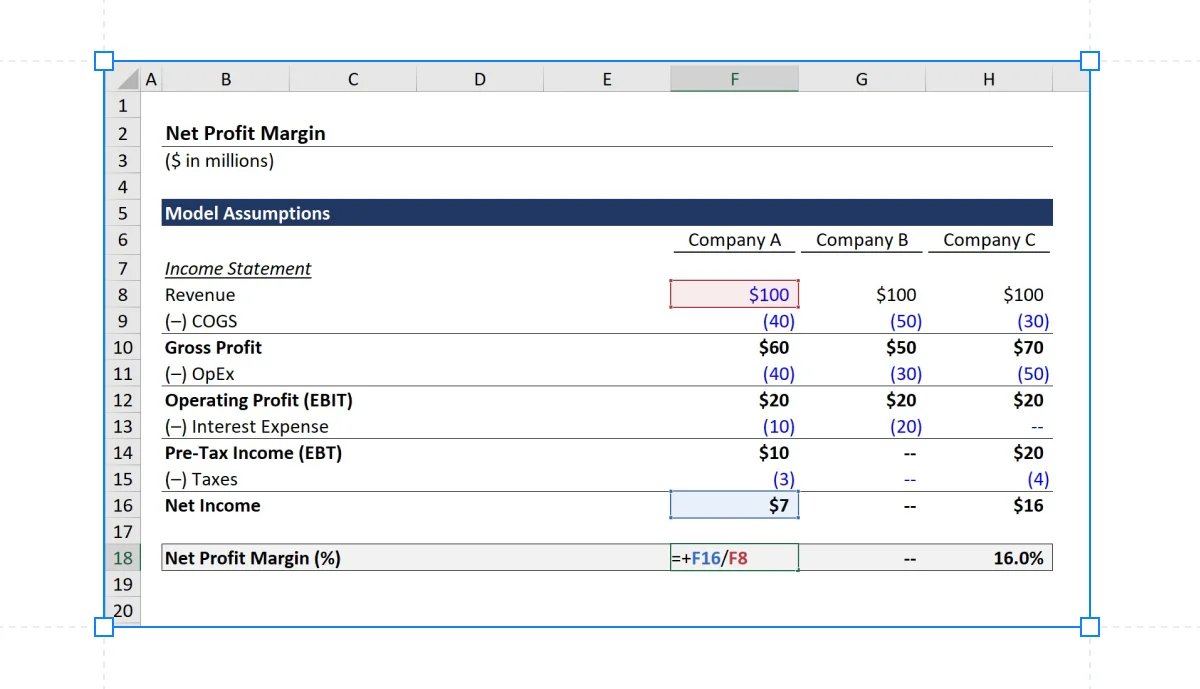

Net profit margin is a financial ratio that calculates the percentage of profit generated by a company based on total revenue.

It is calculated as a percentage of net income divided by total revenue.

In the above example, A, B, and C companies have the same Revenue of 100$.

But costs differ.

The best one is Company C with the lowest COGS expenses of 30$, which leads to the highest Gross Profit of 70$ from all 3 of them!

Here we can see how much cost affects the result.

If you can firmly control your expenses, you take advantage in the start!

When you extract operation expenses (OpEx), company C with the highest OpEx 50$, they are the same again in Operating profit (EBIT)!

Here you can see the trap of different kinds of expenses!

And again, by extracting Interest Expenses and financing, we can see how vigorously they can affect your result.

Now, Company C is first, with no interest expenses, and leads with 20$ in Pre-Tax Income (EBT)!

When you pay taxes, you finally have net income!

Now, divide net income with your revenue in the first line, and here you have your Net Profit Margin.

Company C has the highest Net Income and Net profit Margin with 16%!

Here is a clear example of how the same income but wise management of OpEx and expenses leads you to profitability!

What Exactly Is an Operating Expense?

An operational expense is a cost incurred by a company as a result of its routine business activities.

Operations are the actions that a firm does on a daily basis to run the business and create money.

Operating expenses are distinct from expenses related to project investment (CAPEX) and financing.

Operating expenses, also known as OpEx, include rent, tools, supplies, branding, salaries, assurance, administrative costs, and cash set aside for research & development.

What is Pre-Tax Income (EBT)?

Pre-Tax Income, also known as “Earnings Before Taxes (EBT),” is the amount of money left over after subtracting operational and non-operating expenses but before taxes.

This means subtracting EBIT with Interest Expenses.

Pre-tax income is the remaining income, or taxable profit for bookkeeping purposes, of a corporation in a given period before subtracting income taxes.

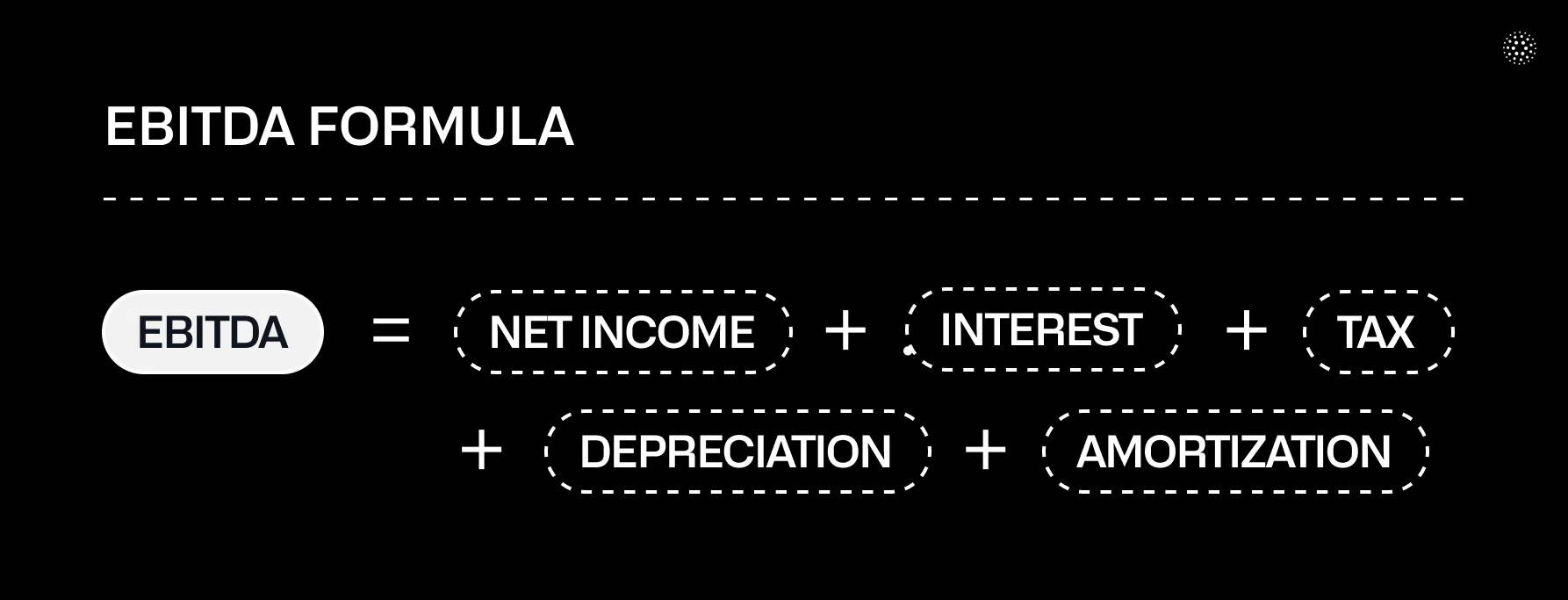

What Exactly Is EBITDA?

EBITDA, which stands for profit before taxes, depreciation, amortization, and interest, is a measure of profitability that is different from net income.

EBITDA seeks to depict the cash profit made by the company’s activities by adding depreciation and amortization, as well as taxes and debt servicing charges.

According to some opponents, EBITDA is useless because it excludes depreciation and investment in capital.

For example:

To Net Income of $30k, add Interest of $5k and $5k of Taxes, with Amortization of $10k, and here is EBITDA of $50k.

Cash Flow Means Life!

Cash flow is the blood circulation of the body of your company.

If it stops, the company will stop living!

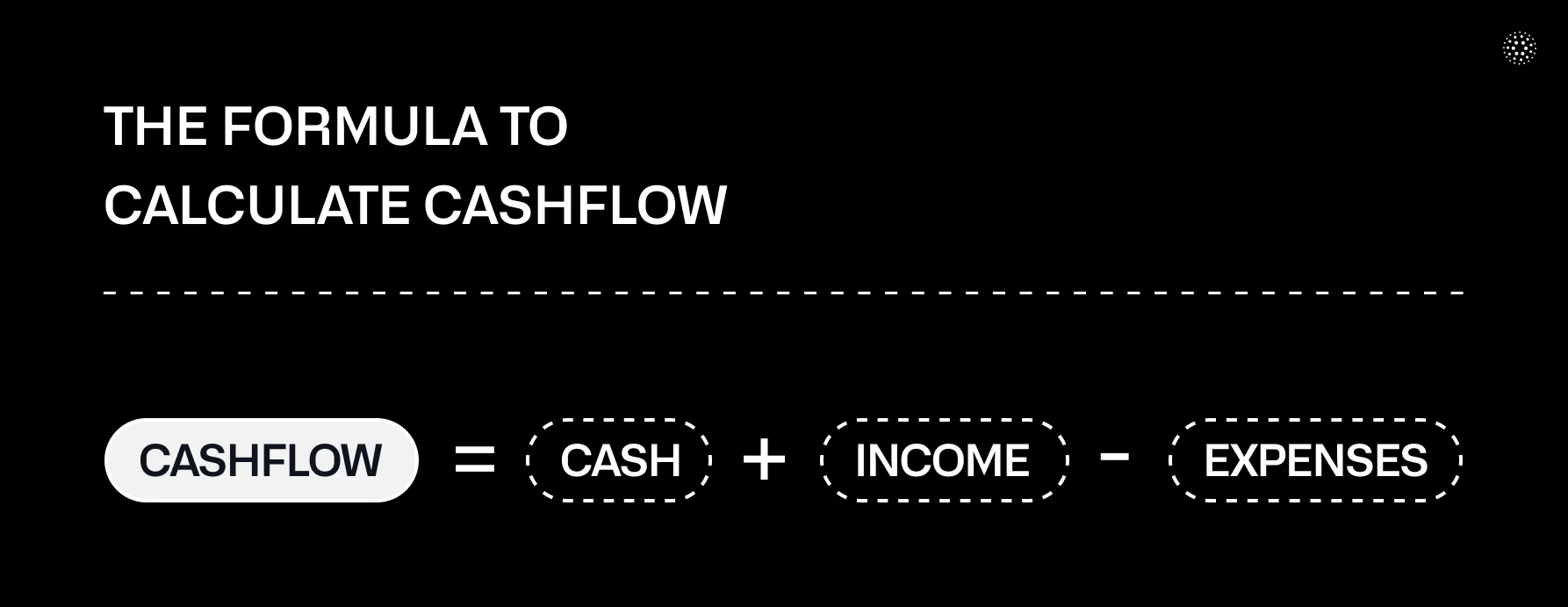

You may calculate your cash flow by adding income to your cash inflow minus expenses at the moment.

To know what you can expect, you need to calculate your cash flow weekly, yearly, and monthly.

Cash is not your revenue.

You have a time lag between invoicing and payment, i.e., cash inflow.

Example of cash flow for the next month:

Cash: $10.000

Income: $30.000

Expenses: $20.000

Cashflow = ($10.000 Cash + $30.000 Income) – $20.000 Expenses = $20.000 Cash Flow

This means that you can count on 20.000$ in cash next month.

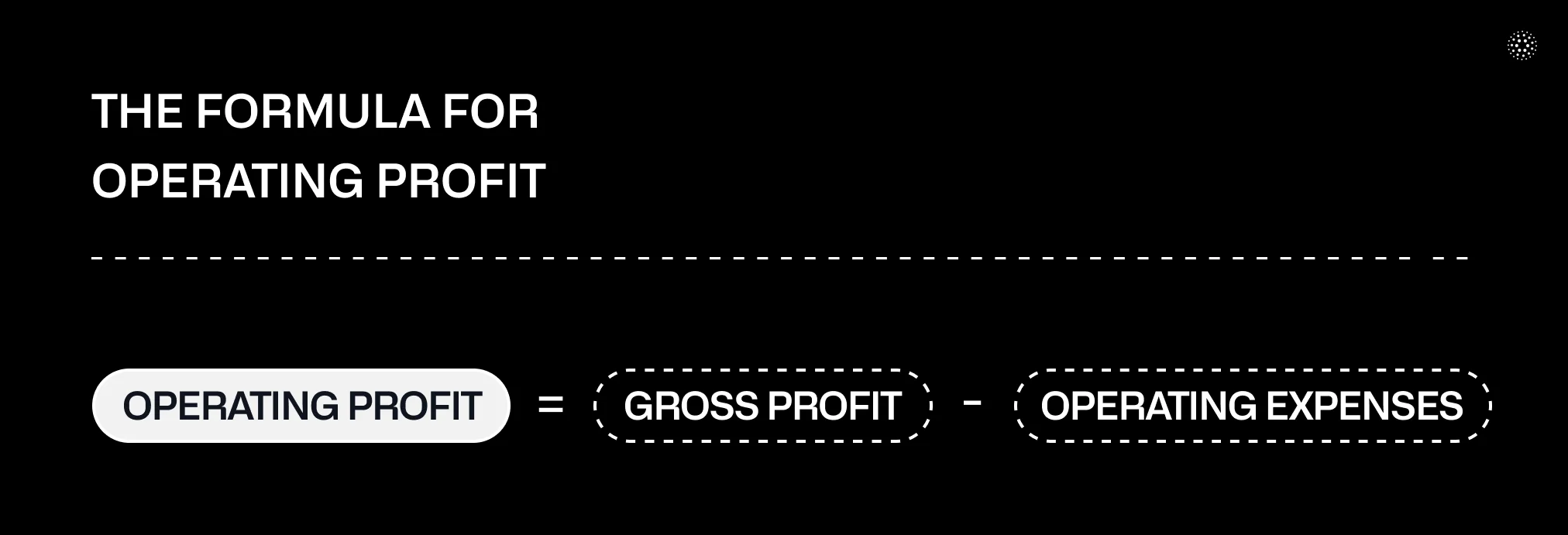

What Is Operating Profit EBIT?

The operating profit of a corporation is the earnings from its main business tasks for a given time minus operating expenses.

It also eliminates income from auxiliary savings, such as income from other firms in which the business has a stake.

An operating loss happens when core company revenue falls short of expenses.

Operating profit eliminates various unnecessary and hidden variables that can hide a company’s performance.

For example:

Step 1:

- Net revenue: $10.000

- Cost of goods sold COGS: -$5.000

- Operating Expenses: -$3.000

Step 2:

- Gross profit = 10.000$ revenue – 5.000$ COGS = 5.000$ gross profit

- Operating profit EBIT = 5.000$ gross profit – 3.000$ operating expenses = 2.000$

Step 3:

- EBIT% = 2.000$ EBIT/10.000$ revenue =0,20 or *100=20%

In this case, the company earns 0.2$ in each of 1$ of revenue generated.

What are Return Ratios?

These ratios deal with the company’s return on stocks and other assets.

Any business makes an investment to profit.

Return Ratios, which test how an investment is managed, are used to examine these returns.

They aid in determining whether the best reward is being delivered on an investment.

What Is Return on Assets or ROA?

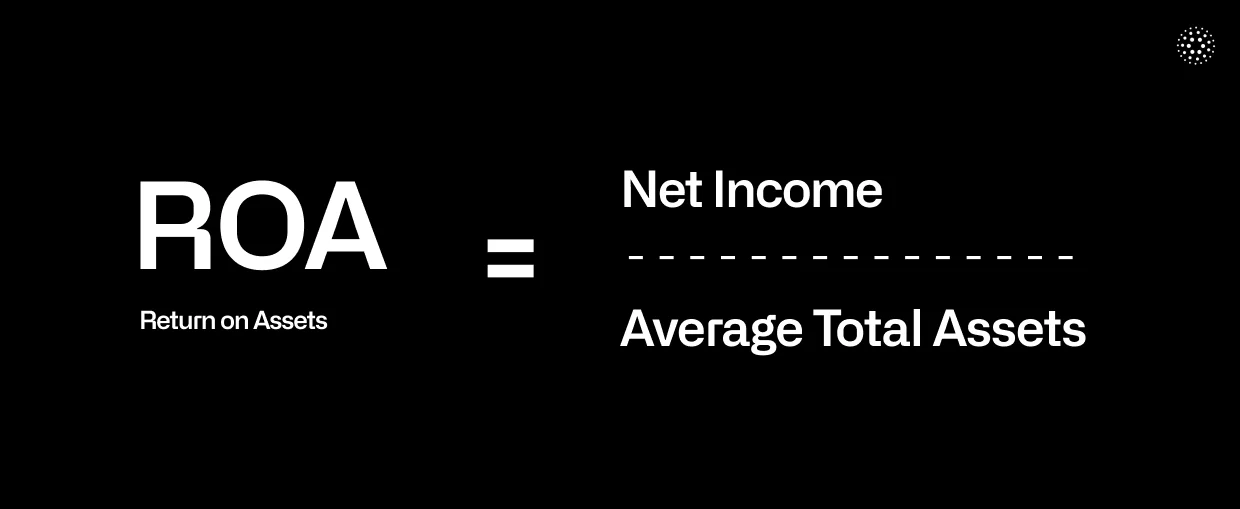

Return on assets, or ROA, is a financial statistic that measures how profitable a firm is in comparison to its assets in total.

ROA is useful to business executives, investors, and analysts to measure the way a business uses its assets to make a profit.

The statistic is a percentage that combines the net profit of a business and average assets.

A greater ROA shows that a corporation is more effective and productive when handling its financial position and making profits, whilst a lower ROA suggests that there is still space for improvement.

For example:

Net income: $20.000

Assets: $60.000

ROA = $20.000 net income / $60.000 Assets = $0.33 or 33%

That means that the company, on each 1$ of net income, reaches 0.33$ of ROA.

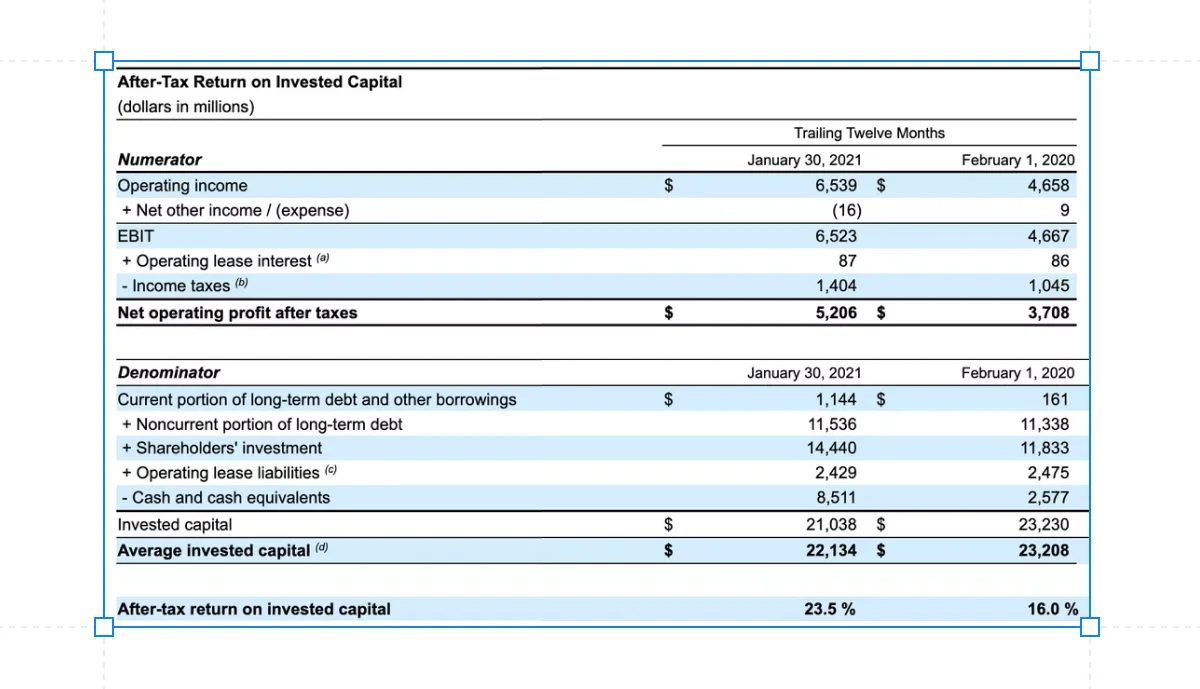

What Is Return on Invested Capital or ROIC?

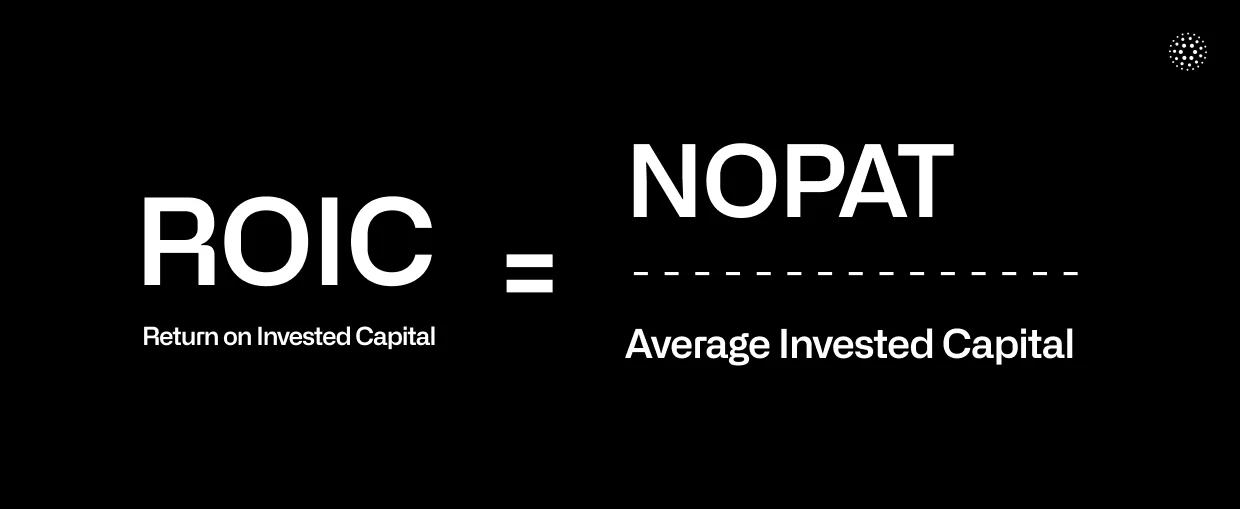

Return on invested capital, or ROIC, measures a company’s ability to set up resources to successful investments.

It is computed by taking the net operating income after tax (NOPAT) and dividing it by invested capital.

ROIC measures how a company uses its money to generate profits.

When a company’s ROIC is compared to its average weighted cost of capital (WACC), it becomes clear whether the money invested is being used.

For example:

In this company, there are the following structure for ROIC:

- NOPAT in 2021 is 5.206$

- Average Invested Capital is 22.134$

- ROIC = 5.206$ of NOPAT / 22.134$ of Average Invested Capital = 0.2352 * 100 = 23,52%

Compared to the previous year, ROIC increased from 16% to 23,5%, which is a good sign of profitability.

In mature companies, comparing year after year ROIC could lead you to conclude about your profitability movement.

If you are heading with an ROIC percentage in your industry, that means you are more profitable than others.

What Is Return on Equity or ROE?

ROE is a financial performance metric determined by splitting the net profit by shareholders’ equity.

The return on equity (ROE) of a corporation is a measure of its profitability as well as its effectiveness in generating profits.

The greater the ROE, indicating more efficient leadership is at creating money and expanding from equity financing.

For example:

Net Income: $10.000

Average Total Equity of Shareholders: $20.000

ROE = $10.000 Net Income / $20.000 of Average Total Equity = 0.5 * 100 = 50%

This means that for every $1 of equity contributed by shareholders, the company will generate $0.5 in net income.

What Is a Profitability Myth?

So what can we consider profitable?

Generally speaking, a margin of 5% is low, a margin of 10% is healthy, and a margin of 20% is large.

Yet, we can not take a one-size-fits-all approach for any, even startup firm.

First, certain businesses are high-margin or low-margin endeavors by nature.

Grocery businesses and retailers, for example, have poor profit margins due to the necessity to buy products, hire laborers, etc, and there are large operating costs.

In contrast, organizations that provide software as a service (SaaS) and consultative services have valuable gross margins.

These companies need less initial funding to launch, have minimal inventory, and have lower running costs.

Businesses that offer expensive luxury goods, such as jewelry and other luxury fashion retailers, may also be in this group with high margins.

For example, let’s imagine 3 companies.

The last segment has $2.5M in revenue and $1.5M in costs.

This leads to $1M of Gross Margin ($2.500.000 revenue – $1.500.000 costs = $1.000.000 Gross Margin).

Other costs are $650.000, which leads to $350.000 of profit ($1.000.000 Gross Margin – $650.000 other costs = $350.000 profit.

This makes the third segment profitable, contrary to the first and second, which makes losses.

On the first look, all three of the companies listed above look succesful.

But, when you look at the numbers, you may see that costs cut down the gross margin.

There is a lack of active customers and high costs that gross margin can not cover!

It is so easy to slide down to losses when you actually expect to gain profit!

One of the biggest untrue stories is to make a profit easily, just if you make a good revenue.

Profit is more than that!

Profit is a matter of good timing when investing, and precise execution of teams, rather than good ideas, business models, and funding of startups.

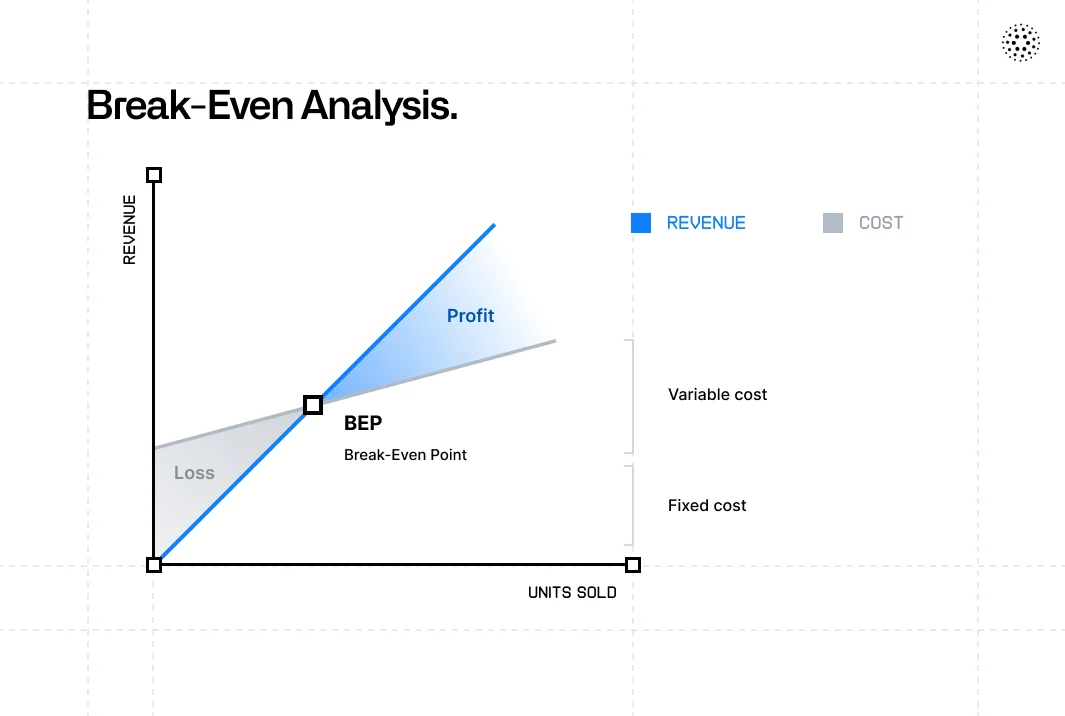

What Is Break-Even Analysis?

Break-even analysis refers to the process of evaluating sales revenue in relation to both fixed and variable operating expenses.

The goal of this analysis is to determine the amount of revenue that you need to pay for all fixed and variable expenses for the company to turn a profit.

As a result of this activity, a startup’s margin of safety based on collected revenues and related expenses can reach its breaking point.

When you pass the Break-Even Point upward into profit, you are on your safe track.

And here again, we are speaking about controlling your costs because they directly influence starting your crucial break-even point.

The main target, above the Break-Even Point, or your profit, we can call the essence of the living cycle of your startup!

For example:

Costs: $1.000.000$

Gross margin: 0.37 or 37%

Break-even = $1.000.000 costs / 0.37 or 37% gross margin = $2.700.000

This means that this company needs to make 2.700.000$ of revenue to cover its fixed and variable costs.

This amount of 2.700.000$ is the Break-Even Point for this company.

If this company makes more sales than 2.7M, they will generate profit.

If it makes less than 2.7M, it will generate a loss.

Why Do We Need to Connect Startups with Profitability Myth?

We are too often surrounded by myths of the overnight rocketing profitability of Startups.

Startups that don’t make money are exposed to criticism and dismissal.

Nonetheless, a lot of investors support these projects because they see the long-term potential.

To ensure their future supremacy, startups are ready to suffer temporary setbacks to focus on expansion and market share.

What Are We Looking For In Searching Startup Profitability?

Besides the explained ratios of profitability, here are also some specific rules to calculate particularly startup profitability:

- Rule of 40% startup profitability

- Rule of 70% startup profitability

What Is the Rule of 40?

Popular Brad Feld’s “Rule of 40,” a company’s profit margin plus revenue growth rate should equal or more than 40%.

The total of the annual revenue increase ratio (%) and the margin of EBITDA (%) is defined by the Rule of 40 equation.

The Rule of 40 shows how well a startup business balances profitability and growth rate.

High-growth startups have to decide between expanding and increasing profitability.

If your startup grows, you may rush into rocketing costs.

But, if you are watching only profitability, against development, you may end in a trap of downcreasing your possibilities.

In these situations, the Rule of 40 provides a useful framework for striking a compromise between the two ideas.

The Rule of 40 often works best for mature, established, and profitable businesses.

The rule aims to connect two of the most crucial indicators for a subscription-based startup business:

1. Growth in Revenue

2. Profitability

When interpreting the corporation guideline, 40% is the starting point.

The company is in an excellent scenario for long-term growth and profitability if the percentage is more than 40%.

*MRR = Active Customers * The average Revenue Per Customer

What does this number mean?

Company C must have a growth rate of 40%, with EBITDA of 0%, to get a 40% rule of profitability.

Besides this, all of them look to have a firm 40% rule.

But, if we look deeper, nobody can afford -20% or 0% of the EBITDA margin in the long run.

It looks like they have issues with cash flow or income, which further leads to the conclusion that there is a decrease in the number of issued invoices.

Furthermore, you need to ask yourself, is this company D hiding some troubles with unpayable invoices or what?

Company B looks like a mature company, with no new customers and steady income from current customers.

The question is: Where are the new accounts?

Company C looks like a new startup.

With a lot of new customers, and new invoices, but not paid yet.

So are there some issues with cash flow?

This could be dangerous for Company C’s survival in the long run.

Company A only looks like balancing between a fresh start and a steady income.

What Is the Rule of 70?

Another statistic for assessing the growth of a startup company is the rule of 70.

The 70-rule One useful method for determining the growth trajectory of a startup.

It says that every seventy months, the growth rate of a company should double its revenue.

It calculates the duration required for a specific metric to double.

For instance, it takes 3.5 years for a startup company with $1 million in revenue and a 20% growth rate to reach $2 million in revenue.

In the end, a lot of money is not a guarantee for growth.

A strong margin of profit is a dependable route to long-term expansion and the creation of a business.

The myth about startup profitability too much simplifies the complex surroundings of today’s business life.

Budgeting is ongoing, continuous work.

You may expect possible cash flow problems, adjust to changes, and make wise decisions by examining and modifying the budget.

Proactive cash management is possible by a dynamic budgeting technique, which also keeps founders ahead of the curve.

Profitability is important, but it’s not the only thing that makes something successful.

Cost-cutting tactics are vital, but if you use only this approach, quality, customer satisfaction, or employee morale may suffer as a result.

In the long period, this can be hazardous.

Founders should, so, approach cash flow management in a balanced manner, combining techniques for increasing revenue with methods for cutting costs.

Also, we can find the timing precious for startup profitability success.

Founders can preserve the possibility for long-term growth while driving stable cash flow improvements by concentrating on both spending management and revenue growth.

Startups can thrive even in the absence of profitability if they are adept at handling their financial flow.

A startup that is profitable does not always have sound cash management.

In this noise of demands, what do you need to succeed?

To succeed and survive, your startup needs to strike a balance between cash flow and profitability.

To Conclude

Profitability is important, but it’s not the only thing that makes something successful.

To determine a startup’s genuine potential, entrepreneurs and investors should take a wider range of elements into account, such as potential for market share, timing, innovation, and strategic growth.

You can increase your startup company’s gross profit margin, draw in investors, and set yourself up for long-term success by controlling the cost of goods and COGS and adopting a product-led growth strategy.

If you would like to hear more, schedule a 30-minute call to learn how to boost your startup’s organic growth and make your business profitable.

Nguồn: omnius.so